The Complete Guide to Studying ACCA in Malaysia

What is ACCA and how many papers will you take? Explore ACCA requirements, pathway and fees for ACCA in this comprehensive guide.

From small kedai runcit businesses to giant conglomerates, millions of companies around the world require the services of an accountant.

And if you're looking to be an accountant and be recognised at a professional level, an ACCA qualification might just be the course for you!

This comprehensive guide will help to answer all your questions about ACCA, such as:

- What is ACCA exactly?

- How can you obtain an ACCA qualification?

- What are the entry requirements to study ACCA?

- Are you only limited to being an accountant with an ACCA qualification?

- Is ACCA really that difficult?

... and more!

Read on to find out everything you need to know about pursuing an ACCA qualification.

Taylor's College

Association of Chartered Certified Accountants (ACCA)

✓Platinum-status Approved Learning Partner of ACCA

#1. What is ACCA?

ACCA stands for the Association of Chartered Certified Accountants. It is a body for professional accountants and is recognised globally, with over 247,000 members in 181 countries and regions.

ACCA consists of a series of professional exams that you need to pass (13 papers in total). As part of the ACCA programme, you will gain technical knowledge in the field of accounting and finance, as well as other areas such as organisational management and strategy.

Upon completion of ACCA's Ethics and Professional Skills module, their Strategic Professional exams plus 3 years of relevant working experience, you will be a Chartered Certified Accountant. This is a term only ACCA members can hold.

Most ACCA members work in accounting and finance fields, typically in the corporate sector. Having an ACCA qualification provides assurance to employers that you have the necessary skills and knowledge in the accounting & finance field, which is why many students opt to pursue this qualification!

#2. Studying ACCA in Malaysia

a) Pathway to Obtaining an ACCA Professional Qualification

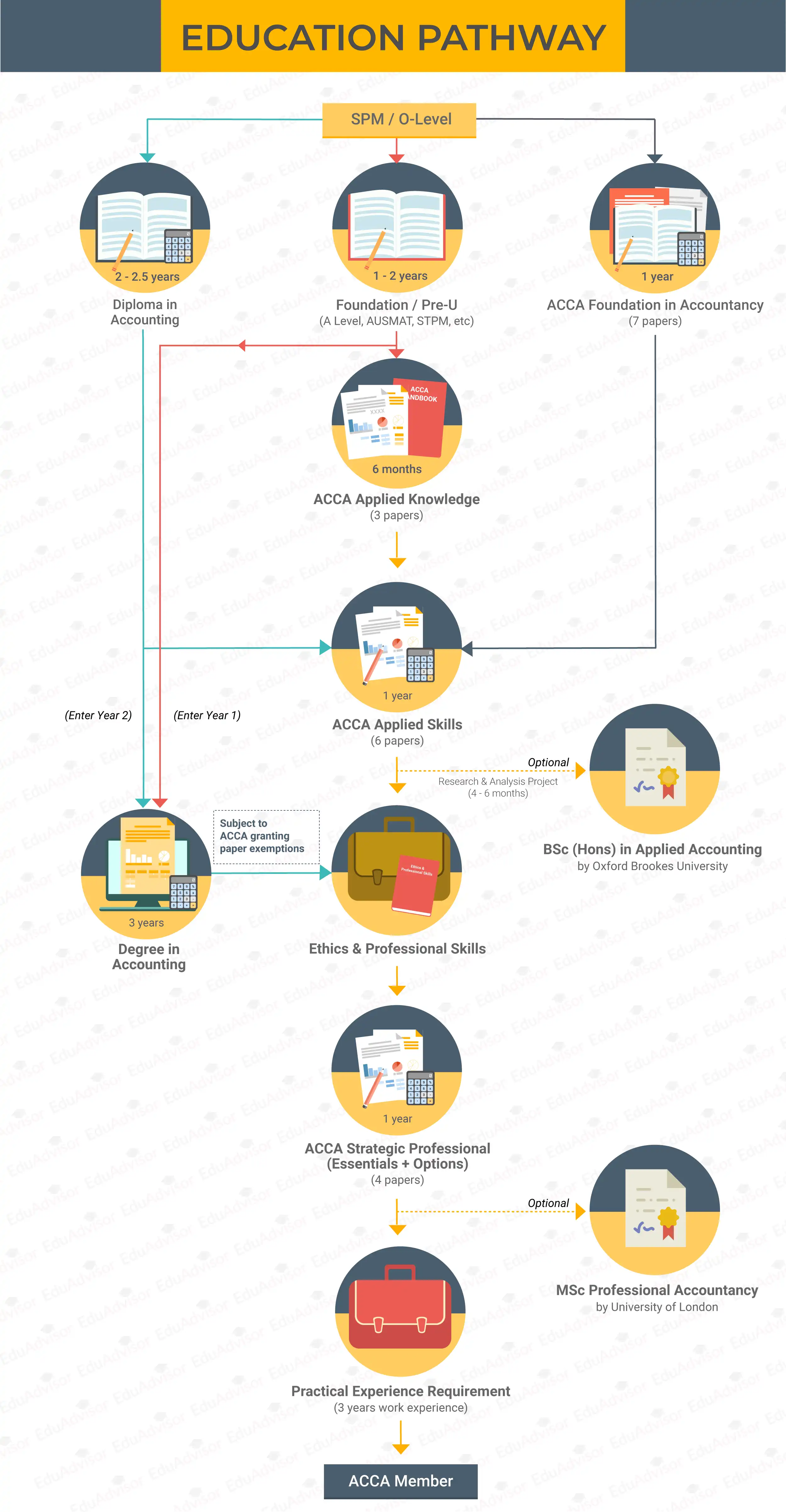

There are several ways to obtain an ACCA Professional Qualification.

Here is a brief summary of the various pathways you can take upon completing SPM.

The three most common pathways are as follows:

(1) ACCA Foundation in Accountancy (ACCA FIA) → ACCA [approx. 3 years total]

This is the fastest and shortest route to obtain an ACCA qualification as you'll complete ACCA in 3 years from SPM.

Upon completion of your SPM or O-Level, you can start your ACCA journey by taking the ACCA Foundation in Accountancy (ACCA FIA). The ACCA FIA is a foundation-level programme that will allow you direct entry into the ACCA qualification. This programme replaces CAT as a direct pathway to ACCA from SPM.

With the ACCA FIA, you will be exempted from the 3 ACCA Applied Knowledge papers upon completion of the programme.

PRO TIP

If you achieved A+/A/A- for your SPM Accounting paper, you’ll be exempted from 1 paper (FA1) under the ACCA FIA.

One concern people often have about pursuing the ACCA qualification is that they may not hold a degree. ACCA offers integrated degree options with partner universities where you can obtain a Bachelors Degree with an ACCA qualification. Currently, ACCA is offering a Bachelors Degree in Applied Accounting with Oxford Brookes University but the programme will no longer be available after December 2026. ACCA is in the process of finalising a new university partnership, which will be announced soon. This section will be updated once new information is available.

(2) Diploma in Accounting → ACCA [approx. 4 years total]

After SPM, you can also choose to take a Diploma in Accounting before proceeding with ACCA. This pathway takes approximately 4 years from SPM.

With a Diploma in Accounting, you will be able to claim some paper exemptions from ACCA, allowing you to progress to the ACCA Applied Skills Level and thereafter, the ACCA Strategic Professional Level.

PRO TIP

You can check the papers that you can claim exemptions from, based on your qualification and institution, with the ACCA exemption calculator

(3) Foundation / Pre-University → Degree in Accounting → ACCA [approx. 5.5 years total]

Another popular pathway is to first obtain a Degree in Accounting prior to pursuing ACCA.

You start with a Foundation or Pre-University programme (e.g. A-Level, Australian Matriculation, STPM, etc.) and proceed with a Degree in Accounting. During this period, you will learn accounting principles and techniques, as well as broader topics outside of accounting, such as economics and investments. Upon completing your degree, you can pursue your ACCA qualification. In fact, many accounting graduates work full-time while studying for ACCA part-time.

Depending on the institution and the subjects that you take, you may be granted exemptions of up to 9 papers for the ACCA Applied Knowledge and Applied Skills modules. This means you get to go directly to the ACCA Strategic Professional module (see next section on "ACCA Course & Exam Structure").

This pathway to a professional accounting qualification is longer compared to the other pathways above. However, it is still a popular option for many students as you will have both a degree and a professional qualification.

At the same time, you will also have the option to pursue a MSc in Professional Accountancy by University of London in addition to your ACCA qualification.

Taylor's College

Association of Chartered Certified Accountants (ACCA)

✓Platinum-status Approved Learning Partner of ACCA

b) ACCA Course & Exam Structure

The ACCA exams are divided into 3 levels — Applied Knowledge, Applied Skills and Strategic Professional.

(1) ACCA Applied Knowledge (3 papers in total)

The Applied Knowledge exams are designed to give you a broad introduction to the world of finance and accounting.

The exams are:

- Business and Technology (BT)

- Management Accounting (MA)

- Financial Accounting (FA)

(2) ACCA Applied Skills (6 papers in total)

Building on your knowledge and understanding of accounting and finance, the Applied Skills papers ensure that you develop strong and practical skills in order to be a strategic professional accountant, regardless of which industry you work in.

The exams are:

- Corporate and Business Law (LW)

- Performance Management (PM)

- Taxation (TX)

- Financial Reporting (FR)

- Audit and Assurance (AA)

- Financial Management (FM)

(3) ACCA Strategic Professional (4 papers in total)

ACCA Strategic Professional aims to prepare you for future leadership positions by developing your technical, ethical and professional skills. This is where you get to choose the area you would like to specialise in.

The Strategic Professional is divided into 2 sections — Essentials (2 papers) and Options (choose 2 exams from 4 options).

The exams are:

Essentials

- Strategic Business Leader (SBL)

- Strategic Business Reporting (SBR)

Options

- Advanced Financial Management (AFM)

- Advanced Performance Management (APM)

- Advanced Taxation (ATX)

- Advanced Audit and Assurance (AAA)

Here is a list of all the ACCA exam papers.

| (1) ACCA Applied Knowledge | |

| AB | Accountant in Business |

| MA | Management Accounting |

| FA | Financial Accounting in Business |

| (2) ACCA Applied Skills | |

| LW | Corporate and Business Law |

| PM | Performance Management |

| TX | Taxation |

| FR | Financial Reporting |

| AA | Audit and Assurance |

| FM | Financial Management |

| (3) ACCA Strategic Professional | |

| Essentials | |

| SBL | Strategic Business Leader |

| SBR | Strategic Business Reporting |

| Options (choose 2) | |

| AFM | Advanced Financial Management |

| APM | Advanced Performance Management |

| ATX | Advanced Taxation |

| AAA | Advanced Audit and Assurance |

c) Entry Requirements and Qualifications

In order to register for ACCA without going through the ACCA Foundation in Accountancy, you must meet the following pre-university entry requirements:

- A-Level: Minimum of 2Es in A-Level and 3 credits in SPM or O-Level, including English and Mathematics

- STPM: Minimum of 2Cs in STPM and 3 credits in SPM, including English and Mathematics

- UEC: Minimum of 5Bs including English and Mathematics

- Matrikulasi: Minimum CGPA 2.50 including English and Mathematics

Do note that certain universities or institutions may have different entry requirements, so make sure you do your research before making a decision!

d) ACCA fees in Malaysia

ACCA fees in Malaysia can range from RM20,000 to RM30,000.

Taylor's College

Association of Chartered Certified Accountants (ACCA)

✓Platinum-status Approved Learning Partner of ACCA

#3. Why Should You Study ACCA?

ACCA is one of the most widely recognised professional accounting qualifications in Malaysia as well as globally. Here are some top reasons why you should study ACCA.

ACCA is one of the most widely recognised professional accounting qualifications in Malaysia as well as globally. Here are some top reasons why you should study ACCA.

(a) Recognised by thousands of employers worldwide

ACCA collaborates with over 8,500 approved employers globally, from multinational corporations and accounting bodies to educational institutions and governments. The ACCA programme also undergoes quality assurance by independent third parties. As such, you can be confident that your professional qualification is well recognised and has a proven reputation for quality.

(b) You get to be in charge of your studies and career

Want to study part-time while working? Or do you prefer to focus and get your professional qualification in the fastest way possible? ACCA has various flexible study options, which means you get to progress at your own pace, whether it’s part-time or full-time. This allows you to switch focus between work and studies, depending on your circumstances.

(c) ACCA opens the doors to many other industries

ACCA does not limit you to being a professional accountant or an auditor. In fact, many ACCA members go on to pursue employment in various fields, such as banking & finance, tax, consulting and business development. Although an ACCA qualification exposes you to many technical aspects and principles of accounting, its syllabus also covers other skills and competencies that are valuable in other industries outside auditing and accounting.

Taylor's College

Association of Chartered Certified Accountants (ACCA)

✓Platinum-status Approved Learning Partner of ACCA

#4. Should You Study ACCA?

a) Is ACCA right for you?

Wondering if ACCA is the right path for you? Here’s some questions to think about:

- Do you like numbers?

- Do you have a good grade in English and Mathematics?

- Do you consider yourself to be meticulous and organised?

- Do you consider yourself an ethical person with critical analytical skills?

- Do you aspire to work in big, global companies?

- Do you want to get certified by an international professional body?

If you answered yes to most of these questions, ACCA may be right for you!

b) Skills required to be an accomplished ACCA member

Here are some key skills a good ACCA member should have:

- Strong proficiency in English and Mathematics

- Ability to communicate effectively

- Good ethics and morals

- Strong drive and determination

- A critical eye with strong attention to detail

#5. What Career Options Do You Have with an ACCA Qualification?

Completing an ACCA qualification will allow you to pursue various job opportunities in the accounting and finance sectors.

- Auditor

- Business Analyst

- Budget Analyst

- Credit Analyst

- Internal Audit Associate

- Investment Banker

- Financial Accountant

- Fund Manager

- Management Accountant

- Research Analyst

- Tax Consultant

#6. Where Can You Study ACCA in Malaysia?

If ACCA is right up your alley, then check out some of the best colleges and universities for ACCA in Malaysia.

Taylor's College

Subang Jaya, Selangor

Association of Chartered Certified Accountants (ACCA)

Intake

Jan, Jul

Tuition Fees

RM33,000

Seats are filling up fast! Secure yours by enrolling through EduAdvisor. Get a RM1,000 registration waiver from Taylor's too! T&C apply.