The Complete Guide to Studying Accounting in Malaysia

Explore the pathway and requirements for an accounting course. Discover how much it costs, career prospects and the top universities for accounting.

If you enjoy dealing with numbers, have good reasoning abilities, whilst having an interest in business, an Accounting Degree might be the course for you!

But are you ready for the critical thinking and challenges involved in this field?

This guide explores everything you need to know about studying an Accounting course in Malaysia, from what it is and how it affects the world, all the way to the career options that you have with an Accounting Degree.

Asia Pacific University of Technology & Innovation (APU)

Bachelor of Accounting and Finance (Honours)

✓Dual-award degree – one from De Montfort University (UK) and one from APU

#1. The Basics of Accounting

a) What Is Accounting?

Accounting involves recording, analysing and reporting financial transactions in order for companies to be able to make strategic business decisions. In addition, accounting is also important to ensure businesses comply with the law (think tax and audit).

Now, this seems like it’s more than you can handle. But the truth is, accounting skills are very practical and can be applied to many areas of your life, such as managing your spending.

For example, to ensure that your college finances do not get out of control (giving you a heads up here!), you’ll need to budget wisely to ensure that your cash outflows (college tuition fees, books, living expenses) are less than your cash inflows (monthly allowance or part-time work income).

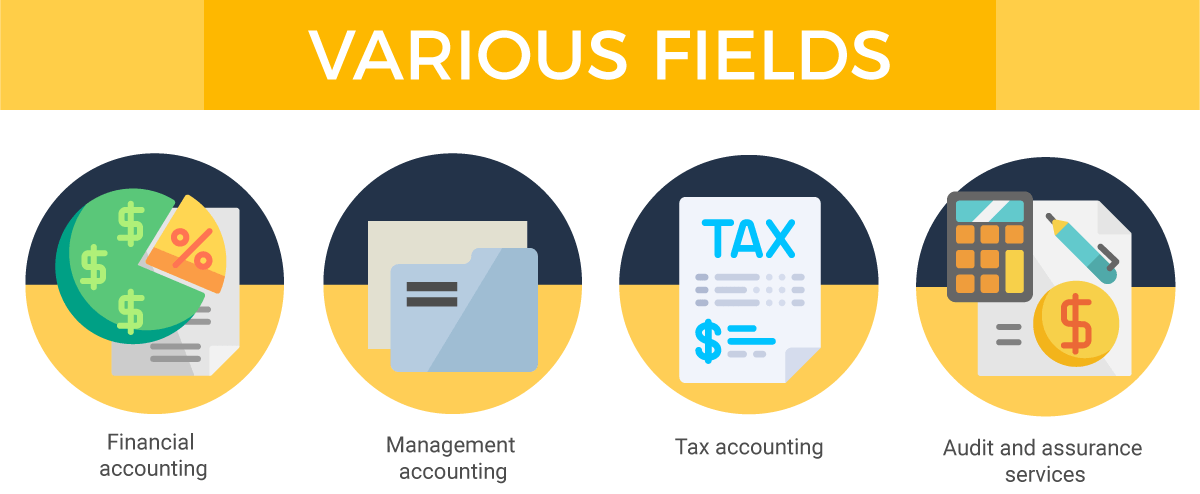

b) What Are the Various Fields of Accounting?

These are the four main types of Accounting usually covered in a degree:

| Field | What It Is All About |

|---|---|

| Financial Accounting | Keeps tabs on financial transactions. Using standardised guidelines and procedures, the transactions are recorded, summarised and presented in a financial report or financial statement. |

| Management Accounting | Information needed by the company management. This includes cost behaviour, product costing for manufacturers, budgeting, magnitude needed for making decisions, and transfer pricing. |

| Tax Accounting | Focuses on taxes, and is governed by the Internal Revenue Code which dictates specific rules that companies & individuals must follow when preparing tax returns. |

| Audit & Assurance Services | Involves concepts and technical aspects of auditing, which is a review or inspection of a company's financial accounts. |

These are the standard fields of Accounting that you will encounter in your degree!

After completion of your degree, you are free to choose to work or specialise in different fields of Accounting.

#2. Studying an Accounting Course

a) Entry Requirements & Qualifications

In order to pursue a degree in Accounting, you will need to meet the entry requirements. Here are the general requirements:

(i) Diploma in Accounting

In order to pursue a Diploma in Accounting, typically you'll need:

- SPM / O-Level: Minimum 3 credits, including a pass in Mathematics and English.

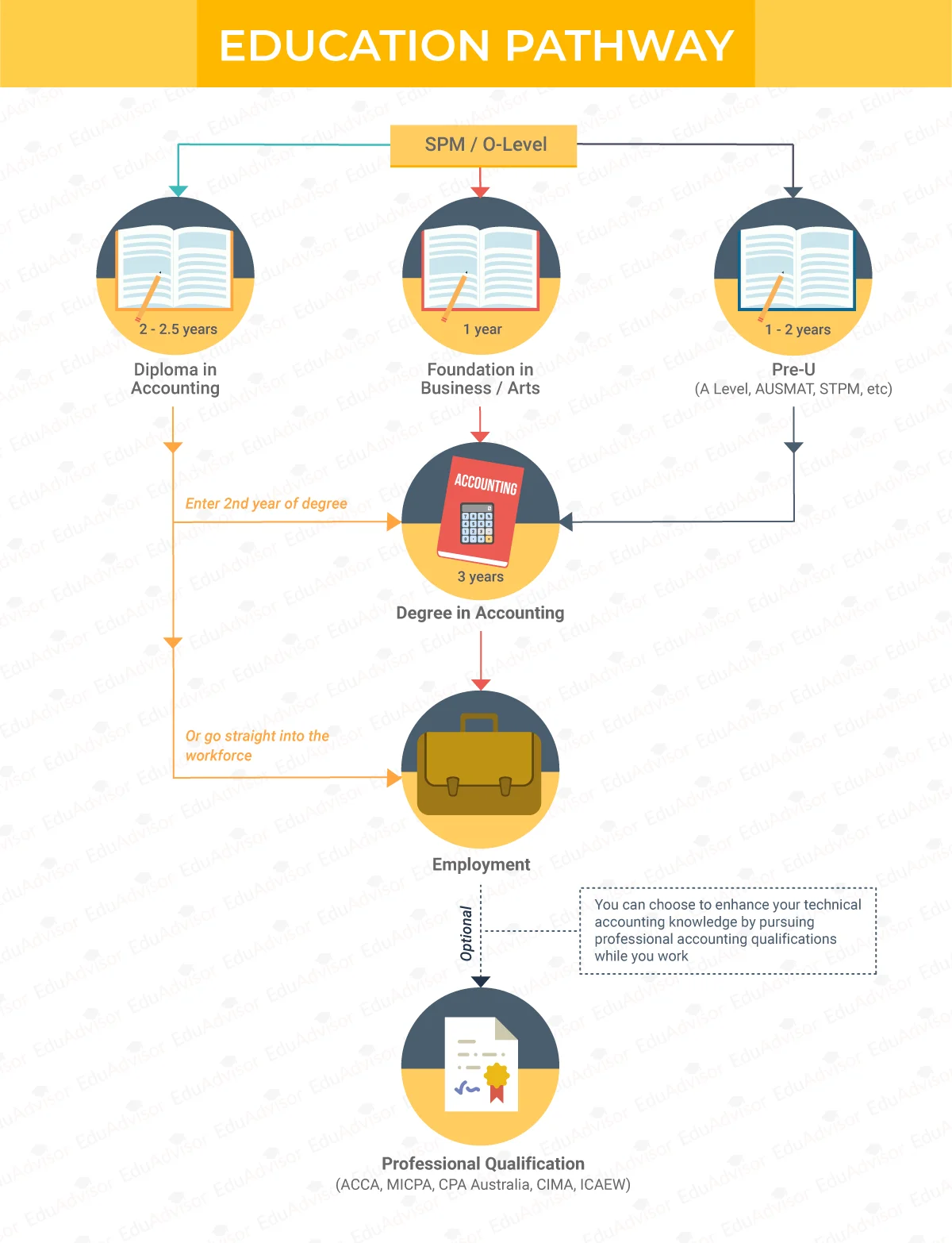

A Diploma in Accounting is usually 2 - 2.5 years long, covering the fundamentals of accounting knowledge and skills.

You can choose to join the working world or go on to do a Degree in Accounting, typically starting from Year 2 of the Degree.

(ii) Degree in Accounting

You will need to complete your SPM or equivalent, AND also complete a Pre-U qualification in order to do a Degree in Accounting.

The basic requirements that you'll need to meet to pursue an Accounting Degree are:

- A-Level: Minimum of 2Ds

- STPM: Minimum of 2Cs

- Foundation in Business or Foundation in Arts: Minimum CGPA of 2.50

- Asasi or Matrikulasi: Minimum CGPA of 2.50

In addition to that, you also need to obtain at least a credit in Mathematics and a pass in English in your SPM.

An Accounting Degree is usually 3 years long.

b) How Much Does it Cost to Study Accounting in Malaysia?

The total estimated fees to pursue an Accounting Degree in Malaysia can range from RM25,000 to RM175,000.

c) How Does Your Education Pathway Look Like?

Generally, upon completion of your SPM or an equivalent qualification, you can choose to progress to a Pre-University course (A-Level, STPM, AUSMAT, etc) or a Foundation in Business or Foundation in Arts. You can also choose to pursue a Diploma in Accounting instead.

Upon completion of your Pre-University, Foundation or Diploma qualification, you can then choose to pursue your Degree in Accounting.

If you want to enhance your technical knowledge in the accounting field and add more bells and whistles to your résumé, you can pursue professional accounting qualifications such as ACCA, MICPA, CPA Australia, CIMA and ICAEW.

PRO TIP

Most Accounting degrees will have courses that cover certain professional papers. Once you finish your degree, double-check to see how many papers you can get exemptions for. For example, some Accounting degrees will exempt you 9 out of 13 ACCA papers.

d) What Will You Study in Accounting?

In general, most Accounting degrees will require you to study core / compulsory subjects in your 1st year, covering topics such as:

- Financial Accounting

- Business Law

- Marketing

- Finance and Investment

- Economics (Microeconomics and Macroeconomics)

- Management Principles

- Quantitative Methods

In your second and third year, you will still have some core subjects, but will also be able to choose some elective subjects depending on your interests.

Asia Pacific University of Technology & Innovation (APU)

APU Foundation Programme (Business & Finance & Psychology)

✓Direct pathway into dual-award degrees at APU

#3. Why Should You Study Accounting?

With so many degree options out there, here are some of the top reasons why you should study Accounting!

(a) Gain practical skill sets

Studying an Accounting course will develop your attention-to-detail, reasoning and critical thinking skills that will be beneficial to you in future. An Accounting course can also be helpful in your daily life, such as managing your monthly budget, and future investment plans. These are demanding skill sets in businesses and companies.

(b) Wide range of options in the future

An Accounting degree will enable you to specialise in a broad variety of Accounting fields, such as tax accounting, financial management, auditing, management consulting, etc. later on. With the exposure to the knowledge of accounting and aspects of business, there is also the possibility of you starting your own accounting firm in the future.

(c) Countless possibilities in Business

An Accounting degree would enable you to constantly learn, develop professional knowledge in the field and help improve systems and businesses. The wide range of business-related topics covered during your Accounting degree will enable you the option and the possibility to change occupations anywhere in the Business field.

Asia Pacific University of Technology & Innovation (APU)

Bachelor of Accounting and Finance (Honours)

✓Dual-award degree – one from De Montfort University (UK) and one from APU

#4. What Skills Do You Need for an Accounting Course?

Here are some of the key qualities and skills that you will need to develop in order to do well in an Accounting course.

(a) Good reading comprehension and command of the English language

There will be many, many documents, research and thick handbooks to read in the search for answers! Thus, good reading comprehension is important for understanding written sentences and paragraphs in documents and standardised guidelines. We recommend a good and strong command of the English language for better comprehension.

(b) Good decision-making skills

Part of Accounting involves decision-making skills by considering the relative costs and benefits of potential actions, in order to choose the most appropriate decision. There may be many types of methods to tackle an accounting problem, so you will need to decide for yourself which method would be best, while sticking to strict guidelines.

(c) Speaking and good communication skills

Bet you assumed Accounting was just about numbers! Speaking and communicating well to convey information effectively is extremely important too. Most people would imagine Accounting to be dealing with numbers all day. This is untrue, as you will most likely have to work in teams or report to people in different chains of command on a daily basis.

#5. What Career Options Do You Have with an Accounting Degree?

After completing your degree in Accounting, here are some career options that you can consider:

- Accountant

- Auditor

- Chief Financial Officer (CFO)

- Financial Controller

- Forensic Accountant

- Investment Banker

- Tax Consultant

If you have suddenly realised that Accounting is not your cup of tea, there are other industries where you can apply the practical skills you have gained from your degree.

Some sectors where your Accounting skills may be useful include:

- Financial Services

- Real Estate

- Telecommunications

- Market Research

- Media & Advertising

- Logistics

Asia Pacific University of Technology & Innovation (APU)

APU Foundation Programme (Business & Finance & Psychology)

✓Direct pathway into dual-award degrees at APU

#6. Where Can You Study Accounting in Malaysia?

Here are some of the most popular universities for Accounting in Malaysia.

Asia Pacific University of Technology & Innovation (APU)

Bukit Jalil, Kuala Lumpur

Bachelor of Accounting and Finance (Honours)

Intake

Mar, Jul, Sep, Nov

Tuition Fees

RM96,600

Malaysia's award-winning Premier Digital Tech University