8 Jobs You Can Pursue With an Accounting Degree

The accountancy field offers a wide range of career opportunities. Find out what are some of the jobs you can pursue with an Accounting Degree here.

Updated 17 May 2022

As one of the most in-demand jobs in Malaysia, accounting is very much needed in every industry. This is why many parents encourage their kids to pursue a Degree in Accounting — it’s where the money’s at.

If you’re embarking on a journey in accounting, you might wonder what jobs are in store for you. Fret not, here’s a list of accounting-related jobs that you can explore with an Accounting Degree.

#1. Auditor

An auditor reviews the financial reports of businesses and organisations to ensure the validity and legality of the records (that is to say, they make sure that there is no attempt to hide or manipulate financial records).

The job involves a slew of responsibilities, including:

- Collating, checking and analysing financial statements

- Obtaining evidence to evaluate the integrity of financial transactions (e.g. physical inventory count, reviewing invoices and payments)

- Examining a company’s financial control systems

- Conducting risk analysis

- Making recommendations for improving financial processes

There are two types of auditors: internal and external.

Internal auditors work within an organisation to examine and improve the company’s processes and business practices. External auditors, on the other hand, work for an audit firm to conduct financial audits for various companies, where yearly audits are required by law.

Taylor's College

ACCA Foundation in Accountancy (FIA)

✓Gold-status Approved Learning Partner of ACCA

#2. Tax consultant

A tax consultant specialises in tax law and regulations, where they use their knowledge to advise clients regarding tax advantages and exemptions while ensuring compliance with the law.

As tax consultants, your responsibilities include:

- Performing tax computations to minimise a client’s tax obligations, penalties and liabilities and maximise deductions and exemptions

- Preparing and filing tax returns properly and on time

- Providing advice on tax strategies in regards to a client’s future financial plans

- Liaising with the Inland Revenue Board Of Malaysia (IRB) on behalf of the client

Tax consultants can choose to work for individuals or businesses. They often work for accounting firms in the tax department, tax consulting firms and in large corporations with in-house tax departments.

#3. Bookkeeper

A bookkeeper is responsible for maintaining accurate records of financial transactions for a company. This job is highly transactional and requires you to enter data into the accounting “books”; hence, the term bookkeeping.

Some of a bookkeeper’s tasks include:

- Recording financial transactions accurately in accounting journals / software based on source documents (e.g. invoices to customers, supplier invoices, cash receipts)

- Issuing invoices to customers

- Paying bills and supplier invoices

- Producing monthly financial statements (e.g. profit and loss statement, balance sheet)

- Conducting monthly reconciliation of accounts to ensure accuracy

Small companies often hire bookkeepers on a part-time basis, while larger companies may require the services of a full-time bookkeeper. For even larger companies, the bookkeeping function may be divided into more specialised functions, i.e. accounts payables and accounts receivables (see point #4), where an accounts specialist will only handle a specific area.

#4. Accounts specialist (accounts payable / receivable)

An accounts specialist manages the financial transactions of a company and ensures that expenses and revenue flow in and out accordingly. In large companies, they are often divided into specialist functions, such as accounts payable and accounts receivable.

An accounts payable specialist ensures that the company’s expenses are paid on time to vendors, contractors and suppliers. On the other hand, an accounts receivable specialist makes sure the company gets paid on time.

As an accounts specialist, your responsibilities include:

- Ensuring that payments are made on time (accounts payable)

- Ensuring invoices are issued to customers on a timely basis (accounts receivable)

- Monitoring debt collection and issuing reminders to customers (accounts receivable)

- Compiling and storing all relevant documentation, such as invoices and quotations

- Reconciling the accounts periodically and analysing discrepancies

Apply for university with EduAdvisor

Secure scholarships and more when you apply to any of our 100+ partner universities.

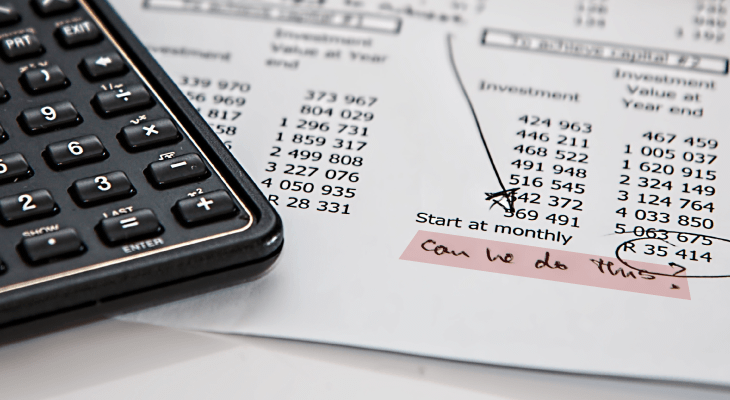

Start now#5. Accountant

An accountant classifies, analyses and reports financial data in order for companies to be able to make strategic business decisions.

Some of their key responsibilities include:

- Examining statements, records and transaction to ensure that they are accurately reported and are compliant with laws and regulations

- Analysing, interpreting and preparing reports on financial statements

- Managing the company’s financial systems and budgets

- Advising on tax, audit and financial regulation issues

- Conducting financial forecasting and risk analysis

In contrast to bookkeepers and accounting specialists, accountants have the main responsibility of analysing and interpreting the data bookkeepers have recorded into the ledgers. Accountants in a company may also be tasked to prepare budgeting proposals and provide financial recommendations to the company.

DID YOU KNOW

You can be a chartered accountant when you pursue a professional accounting qualification such as the Association of Chartered Certified Accountants (ACCA), the Institute of Chartered Accountants in England and Wales (ICAEW) or the Chartered Institute of Management Accountants (CIMA).

Taylor's College

ACCA Foundation in Accountancy (FIA)

✓Gold-status Approved Learning Partner of ACCA

#6. Management accountant

A management accountant focuses on reporting and analysing financial information and aiding managerial planning so that the company can achieve its goals and objectives.

The role varies depending on a company’s structure, but a management accountant’s typical responsibilities include:

- Preparing and analysing financial reports

- Planning budgets and ensuring spending is in line with the budgets

- Preparing financial forecasts and contribute to long-term business planning

- Working with various functions and departments to put accounts into context

- Advising on financial implications of business decisions

Management accountants often work in various organisations in finance departments. Additionally, they can also work in accounting and consultancy firms.

#7. Financial controller

A financial controller (or corporate controller) is a senior position that accountants can progress to. They are responsible for the overall operations in the finance and accounting department.

Some of a financial controller’s tasks include:

- Leading and overseeing the finance and accounting operations

- Ensuring month-end closing and financial reporting are performed accurately and on time

- Managing the company’s budget plans and cashflow

- Ensuring that the company’s accounting systems and processes adhere to guidelines

- Providing strategic direction to the management from a financial perspective

The role of a financial controller is crucial to any company to ensure that the company maintains its financial integrity. Financial controllers often have extensive experience and a solid background in financial and management accounting.

#8. Lecturer / Teacher

An accounting educator has the responsibility of teaching and helping students learn about the field of accounting. Their tasks include planning lessons, assignments and exams, preparing teaching materials as well as grading papers.

Lecturers in universities may be required to carry out research and publish research papers (either individually or in collaboration with peers) in the field of accounting. Senior lecturers may also contribute to the review and development of the institution’s curriculum to ensure that students are well-equipped with the right skills and knowledge when they graduate.

As you can see, having an Accounting Degree under your belt presents you with a plethora of career opportunities within the accountancy field alone. While we can’t guarantee which jobs boast the most attractive salary, it does pay to be hands-on and start from the bottom and pick up all the skills you need before climbing the corporate ladder.