5 Myths About ACCA and ACCA Foundation in Accountancy

Wondering if the myths surrounding ACCA / ACCA FIA are true? Find out as we debunk them in our article.

Updated 18 May 2019

"Why do you need ACCA? An accounting degree is enough."

"You can’t study ACCA if you didn’t take Accounting for SPM."

"Are you sure you want to take ACCA? It's so hard!"

If you’ve ever voiced your intention of pursuing ACCA (Association of Chartered Certified Accountants) or its foundation programme, the ACCA Foundation in Accountancy (ACCA FIA), you might have heard at least one of the statements above.

But is there any truth to them?

To help you decide on your future without being led astray, we’re debunking the most common myths about ACCA and ACCA FIA. Read on to discover the truth!

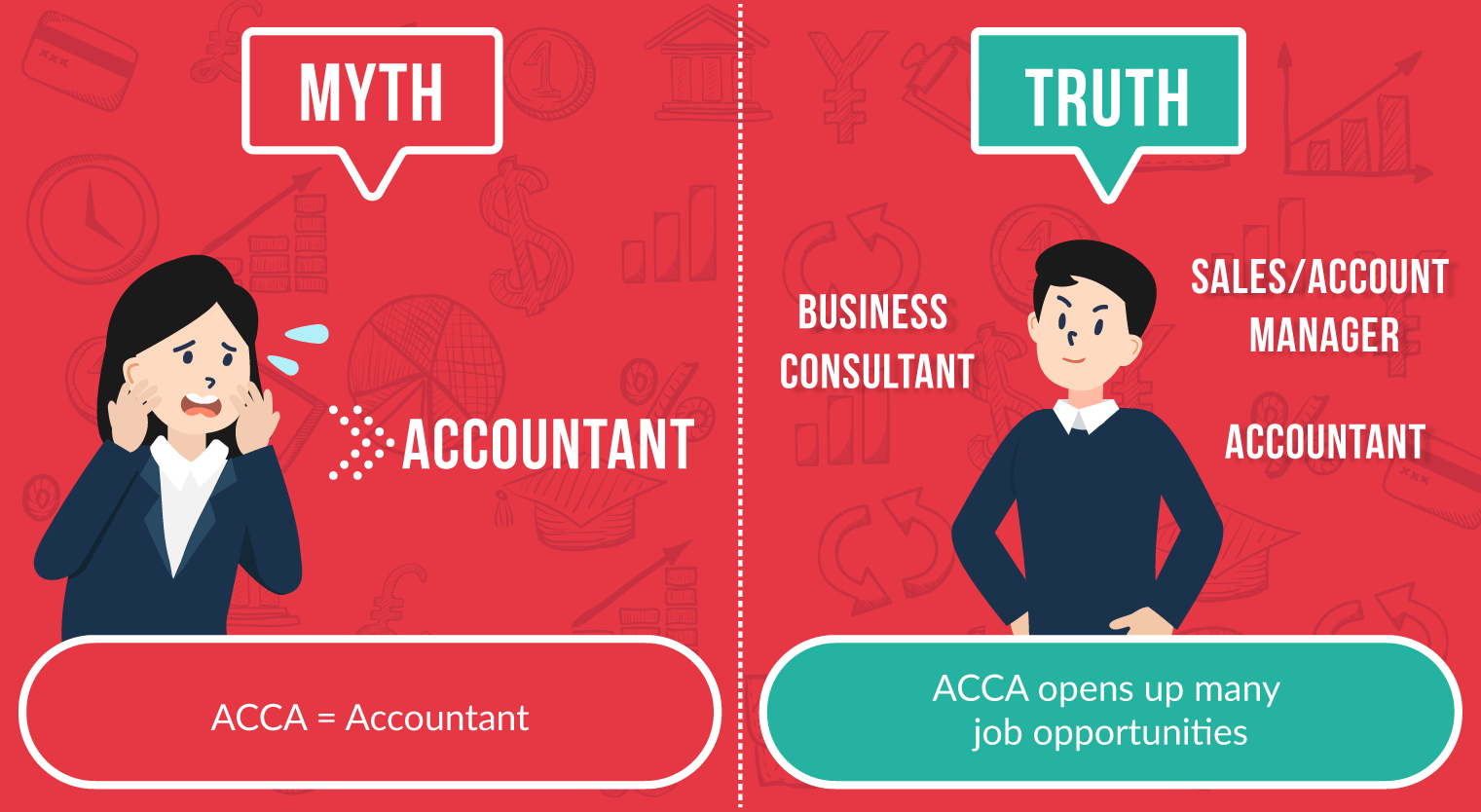

Myth #1: You can only be an accountant with ACCA

While most people think their future career options will be restricted to being an accountant for the rest of their lives if they take up ACCA, it's a big misconception that's far from the truth.

Having an ACCA qualification gives you the freedom to pursue any career and passion you want! In fact, studying the course will equip you with transferable skills that can prove useful in other industries, such as sales/account manager for accounting software or business consultant.

In fact, the expansive financial knowledge you gain grants you the versatility to climb the ladder from junior accountant to financial controller (and even Chief Financial Officer!) with ease. You can even toss your hat into the entrepreneurial ring and enjoy success in a start-up.

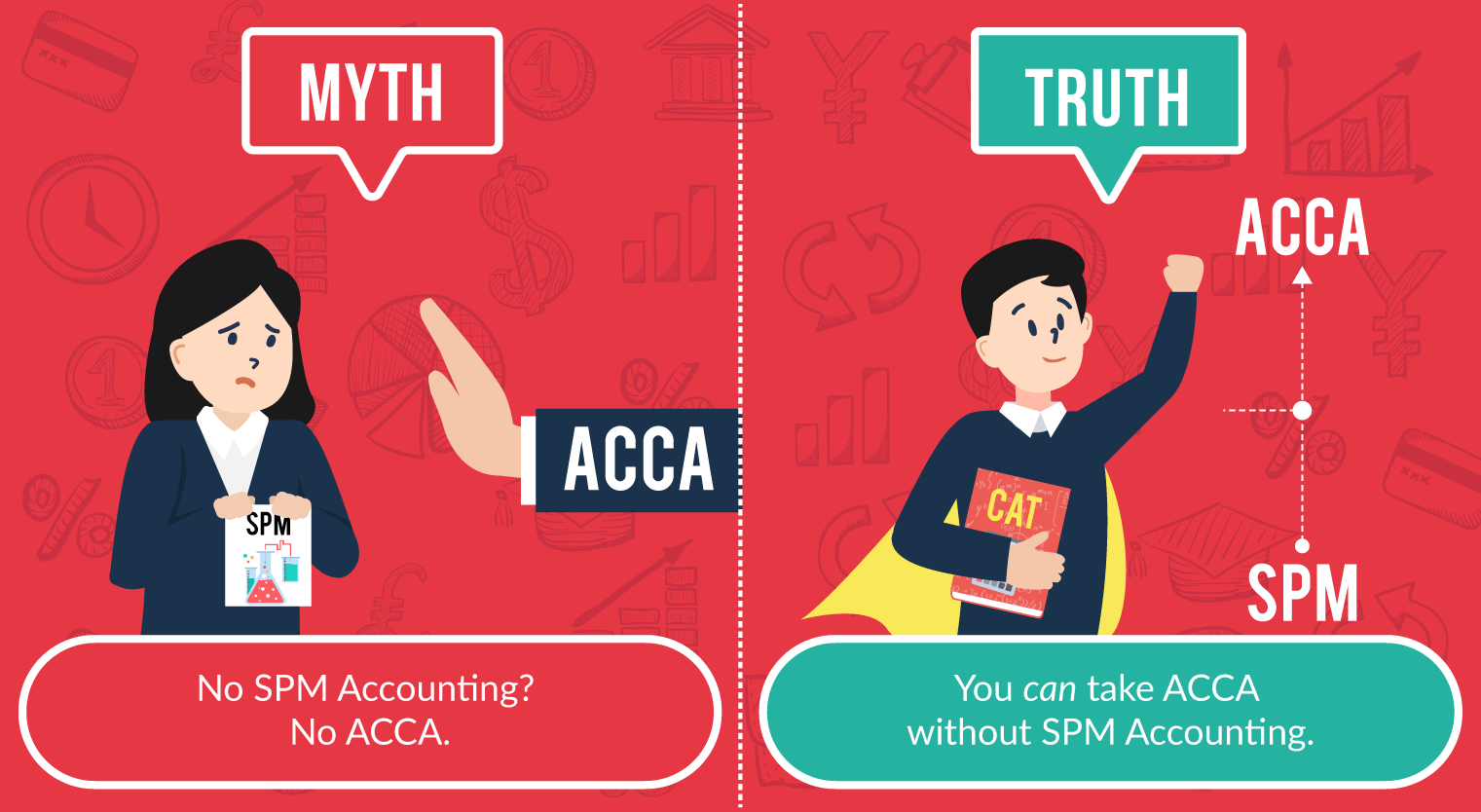

Myth #2: You can't study ACCA if you didn't take Accounting for SPM

You may have been told that you can kiss your ACCA dreams goodbye if you were a science stream student in secondary school. After all, how can you possibly pursue ACCA if you didn’t take the Principles of Accounting paper for SPM?

Surprisingly enough, you can!

ACCA offers the ACCA Foundation in Accountancy (ACCA FIA), a foundation-level qualification that will turn you from zero to accounting hero as you pick up financial and management accounting knowledge. Once you've completed the ACCA FIA, you can move on to ACCA, which is where you'll develop your skills and knowledge even further to be an accounting ninja.

DID YOU KNOW

Not sure you'll be able to follow your lectures with your limited accounting background? Taylor's College offers a cool lecture capture system called ReWIND @ Taylor's, where it records lectures automatically. With this, you can review your material after class by viewing the recorded lecture online at the convenience of your own home.

Taylor's College

Association of Chartered Certified Accountants (ACCA)

✓Platinum-status Approved Learning Partner of ACCA

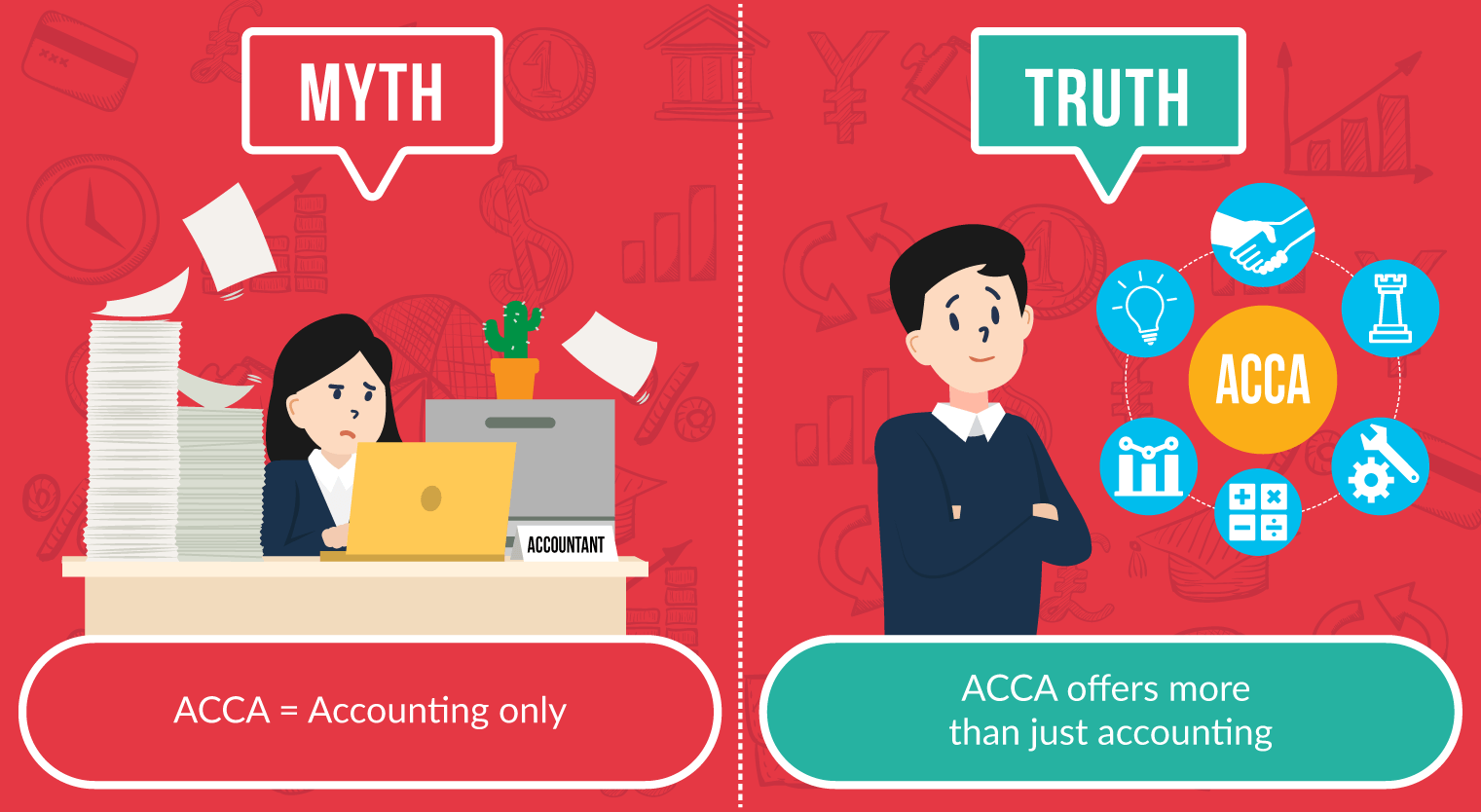

Myth #3: ACCA only teaches you to be an accounting whizz and nothing else

With all the accounting terminology hurled at you in ACCA, it's hard to think how your accounting know-how can be applied elsewhere.

The truth is, it can!

More than just accounting, ACCA also arms you with practical business skills where you'll be given real-world scenarios to tackle. In fact, other professionals such as lawyers and business owners also take up ACCA as the financial knowledge they glean will be useful in their work.

In addition, an accountant's role is no longer shackled to the number cruncher of the past, as today’s accountant requires professional skills beyond the realm of numbers. ACCA nurtures key professional behaviours throughout the programme, such as acting ethically and legally, being a problem solver and being bold to challenge and influence others.

PRO TIP

Interested in becoming a chartered accountant? Here's a summary of how to get there from SPM.

Myth #4: ACCA is really hard

Well... yes, and no.

While its notoriety precedes it, the ACCA course material — while not easy — isn’t too tough a nut to crack. ACCA is application-based, which means you have to learn concepts and then apply them to real-life scenarios. Where people may stumble is by relying on pure memorisation to get through the exams, which may not work well.

As with all things worth doing, you'll need to put in the time and commitment. This is where ACCA shines as it is extremely flexible. Choose between part-time or full-time study, or even self-study. You can also take more or fewer papers each time, and choose from one of ACCA's many learning partners.

DID YOU KNOW

By studying ACCA FIA/ACCA at Taylor's, you'll be able to gain mentorship from their "Star" lecturers. These are ACCA lecturers with Master's Degrees that have been trained in various institutions, maximising your chances of passing your ACCA exams!

Myth #5: ACCA isn’t that useful in the workforce; an accounting degree is enough

“Pfft, why do I need ACCA if I’m going to pursue an accounting degree?” you might say.

Well, we’ve got news for you. Many large accounting firms, especially the Big Four (Deloitte, Ernst & Young (EY), KPMG and PricewaterhouseCoopers (PwC)), urge their employees to pursue professional accounting qualifications like ACCA. In fact, some may even subsidise your ACCA fees and give you time off to study. Additionally, promotions and salary increments may be influenced by whether or not you have a professional accounting qualification.

The reason for this is because having the ACCA qualification under your belt shows that you’ve got the right professional and technical knowledge. So, while a Degree in Accounting, Business or Economics is okay, an ACCA qualification will give you the extra edge you need, especially if you’ve set your sights on senior management positions.

DID YOU KNOW

Studying accounting at a credible institution will improve your chances of being hired by the Big Four. With Taylor's, rest assured that you'll be in good hands as Taylor's has a holistic learning programme to develop you into a forward-thinking employee.

And there you have it — the 5 major myths about ACCA FIA and ACCA which may be stopping you from having a successful career. Now that we’ve smoothly debunked them, you can confidently pursue these qualifications and be on your way to becoming a chartered accountant!

4 Reasons Why You Should Study ACCA FIA/ACCA at Taylor's

Visit Taylor's College for more information on ACCA FIA and ACCA.

Find scholarships, discover programmes and connect with Malaysia's top institutions at the EduAdvisor Virtual Education Fair — happening this 12 March – 26 April 2026! Click here to register.

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Registration Waivers, Discounts and Rebates: EduAdvisor students often enjoy additional waivers, discounts and rebates during registration due to our close relationship with universities.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Registration Fee Waiver: A 100% registration fee waiver is available for all EduAdvisor students using this waiver code — AGE24

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Head over to: https://www.rumc.edu.my/apply-now/

Remember to use the following waiver code to be eligible for a 100% waiver on the application fee and our EduAdvisor Registration Reward: AGE24

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Head over to: https://admission.unikl.edu.my/online/frmHome.php

Remember to use the following public agent code to be eligible for our EduAdvisor Registration Reward: PA0001

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Head over to: https://application.mmu.edu.my/

Select “Agent ID”, fill in the EduAdvisor agent code: AG0000409 and select Distinctive Education Advisor to be eligible for our EduAdvisor Registration Reward.

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Head over to: https://oculus.uts.edu.my/apply/signup.php

Remember to use the following agent ID to be eligible for our EduAdvisor Registration Reward: DEA

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Registration Fee Waiver: A 50% registration fee waiver is available for EduAdvisor students during selected UCSI events.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Head over to UCSI’s website here.

Remember to use the following agent code to be eligible for our EduAdvisor Registration Reward: 779700

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Registration Fee Waiver: A 50% registration fee waiver is available for EduAdvisor students during selected UCSI events.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Head over to UCSI’s website here.

Remember to use the following agent code to be eligible for our EduAdvisor Registration Reward: 100023

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Tuition Fee Rebate: A RM1,500 tuition fee rebate is available for EduAdvisor students during selected NUMed events.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Head over to: https://application.newcastle.edu.my/registration?ref=1652487az1ydp0i

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Head over to: https://intake.utmspace.edu.my/refer/63c50d45156c8

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Early Bird Waiver: A waiver of RM1,000 is available for all EduAdvisor students enrolling in this programme. T&C applies.

- Edu Assist: A tuition fee waiver of up to 35% is available for students that are from low income family. T&C applies.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- RM500 Rebate: A rebate of RM500 is available for all EduAdvisor students enrolling in this programme.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Registration Bursary: A further discount of RM1,000 is available for eligible students enrolling in this programme.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Open Day Waiver: A further waiver of RM450 to RM800 is available for eligible students enrolling in this programme during IMU's Open Day events.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Application Fee Waiver: A RM100 application fee waiver code is available for EduAdvisor students during selected Monash events.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Registration Fee Rebate: A registration fee rebate of up to RM1,000 is available for EduAdvisor students enrolling in this programme.

- Early Bird Waiver: An early bird waiver of RM1,500 is available for EduAdvisor students enrolling in this programme for the July 2024 intake.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Early Bird / Event Day Waiver: A fee waiver of RM500 is available for all EduAdvisor students enrolling in this programme. T&C applies.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Open Day Waiver: A application fee waiver of up to RM500 is available for all EduAdvisor students enrolling in this programme during MAHSA's Open Days.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Registration Fee Waiver: A Registration Fee Waiver of up to RM500 is available for EduAdvisor students.

- Special Tuition Fee Waiver: A further discount of RM1,000 is available for eligible EduAdvisor Students enrolling in this programme.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Registration Fee Discount: A rebate of RM500 to RM1,000 is available for EduAdvisor students enrolling in this programme.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Event Waiver: A RM500 admin fee rebate is available for all EduAdvisor students during selected UM-Wales events. T&C applies.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Registration Waiver: A rebate of RM1,000 to RM2,000 is available for EduAdvisor students enrolling in this programme.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Application Fee Waiver: A fee waiver of RM150 is available for all EduAdvisor students enrolling in this programme. T&C applies.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Open Day Rebate: A RM500 rebate is available for EduAdvisor students during MCKL's events.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Open Day Waiver: A application fee waiver of up to RM500 is available for all EduAdvisor students enrolling in this programme during MAHSA's Open Days.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Head over to: https://at.edv.my/apply-mahsa

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Registration Waivers, Discounts and Rebates: EduAdvisor students often enjoy additional waivers, discounts and rebates during registration due to our close relationship with universities.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Generating your application

Hang tight! This will only take 1-2 minutes...

0%

Your application form is ready

We've prepared your university application based on the details provided. Review and sign to complete your university application.

Submitting your application

Hang tight! This will only take 1-2 minutes...

0%

Your application form is submitted

Melissa Mazlan

Your friendly Klang representative who enjoys romantic walks to the fridge.