How to Be a Chartered Accountant in Malaysia

What is the pathway to hold the title of a chartered accountant? Here’s a guide on how you can be one in Malaysia from SPM.

Published 27 May 2022

Do you love solving problems and have good reasoning abilities? Are you detail-oriented, practical and organised? Have a keen interest in the accounting world and want to help companies analyse profit margins and make good business decisions?

If so, you’re the perfect fit to become an accountant!

Accounting is a professional industry, so if you want to improve your technical knowledge and add more bells and whistles to your résumé, becoming a chartered accountant is the way to go. This will give you an industry edge and help you stand out from the crowd.

So, what can you do to become a specialist in the accounting world? We’ve prepared a step-by-step guide on how you can qualify to be a chartered accountant in Malaysia from SPM.

#1. Meet the entry requirements at SPM level

To be eligible to pursue any accounting qualification, you must have at least a credit in Mathematics and a pass in English at SPM level.

Depending on what course you choose (e.g. foundation, diploma, professional qualification), the entry requirements for English could be higher.

Taylor's College

ACCA Foundation in Accountancy (ACCA FIA)

✓Platinum-status Approved Learning Partner of ACCA

#2. Complete a pre-university or foundation programme

Upon completing SPM, you’ll need to take a pre-university course (e.g. A Levels, STPM, etc.) or a foundation programme. Foundation in Arts and Foundation in Business are recommended, but Foundation in Science is acceptable too. The minimum requirement is 5Cs including a credit in Mathematics and a pass in English at SPM level. With this qualification together with your SPM, you can proceed to a Degree in Accounting.

Alternatively, you can complete a Diploma in Accounting instead if you have a minimum of 3Cs including Mathematics and a pass in English. This will enable you to pursue a Degree in Accounting, going directly to Year 2.

Alternative route via professional qualification:

In order to be a chartered accountant, you can also pursue a professional qualification (e.g. ACCA, ICAEW, CPA) instead of an academic pathway.

For ACCA, you can take the ACCA Foundation in Accountancy (ACCA FIA). This is the shortest and most direct route to obtaining an ACCA qualification after SPM (approximately 3 years). To pursue this course, you’ll need a minimum of 5 credits including Mathematics and English. If you have scored (A+/A/A-) for your SPM Accounting paper, you’ll be exempted from 1 paper (FA1) under the ACCA FIA. Thereafter, you can proceed with pursuing the ACCA professional qualification (refer to Step #4).

Note that as it is a direct pathway to a professional qualification, you cannot use ACCA FIA to pursue an accounting degree. However, it’s certainly a shortcut to pursuing ACCA and becoming a chartered accountant.

#3. Complete a Degree in Accounting

Once you complete a pre-university, foundation and diploma, you can proceed with a Degree in Accounting. As part of your accounting studies, you will cover a range of topics including financial accounting, management accounting, tax accounting, audit and assurance services.

Most accounting degrees are typically 3 years long. Once you graduate, you’ll be able to enter the workforce. However, you’re not a chartered accountant until you take a professional qualification.

Alternative route via recognised qualifications by MIA:

Alternatively, you can also pursue an accounting degree that’s recognised by the Malaysian Institute of Accountants (MIA). These degrees are usually 4 years long and are only offered by a selected number of universities.

By taking a recognised accounting degree by MIA, you can skip taking a professional accounting qualification and go straight to gaining practical working experience (see Step #5).

Apply for university with EduAdvisor

Secure scholarships and more when you apply to any of our 100+ partner universities.

Start now#4. Pursue a professional accounting qualification

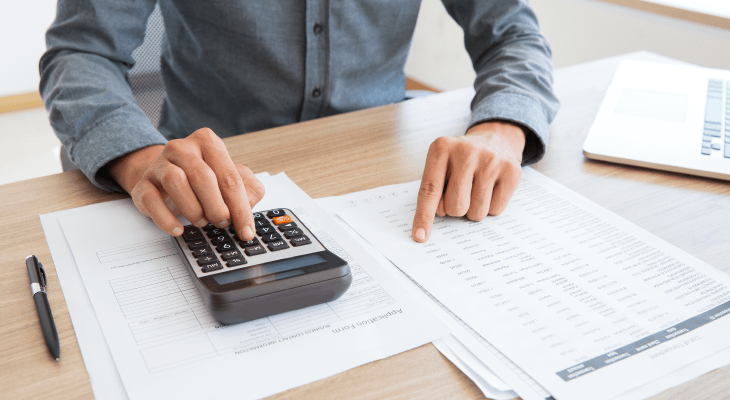

Completing an accounting degree does not give you chartered accountant status. To become one, you will need to take a professional accounting qualification, which is an advanced credential that provides you with specialised training in accounting. These qualifications are globally recognised and provided by international accounting bodies such as ACCA, ICAEW, CPA Australia and CIMA.

Each professional body has its own set of examinations and standards. Regardless of which you choose, there will be a series of professional papers that you have to pass. Most of these qualifications will take about 3 - 5 years to complete, depending on the route you take and your commitment. Some people pursue this part-time while working, while others do it full-time.

PRO TIP

If you pursue a Degree in Accounting, you will usually be exempted from some of the professional papers. Double-check to see how many papers you can get exemptions for as this can shorten your study duration.

Taylor's College

ACCA Foundation in Accountancy (ACCA FIA)

✓Platinum-status Approved Learning Partner of ACCA

#5. Gain practical working experience

In order to be an official member of a professional accounting body, you must gain practical work experience in addition to passing your professional exams. This is so that you’ll be able to put into practice what you’ve learned. The duration differs depending on the accounting body but the requirement is usually 3 years. Completing this, on top of passing your professional papers, will allow you to be an official member of the professional accounting body.

If you have taken a 4-year accounting degree that’s recognised by MIA, you will also need to achieve a minimum of 3 years working experience before registering with MIA as a chartered accountant.

#6. Get registered

Once you’ve passed all your professional papers (or graduated with a recognised degree by MIA) and completed your 3-year work experience, you can proceed to register as a Chartered Accountant with MIA. At this stage, you’ll be able to use your title as Chartered Accountant and offer specialist accountancy services and business advice in a range of areas.

But what if you don’t have a professional accounting qualification? Can you still become a chartered accountant?

Yes, there is still an alternate pathway for you, which is to sit for the MIA Qualifying Exam. This pathway will require you to sit for 4 exam papers and pass all of them within 4 years. You will also still need to fulfil the 3-year work experience requirement. To be eligible for this pathway, you must have a relevant degree in accounting.

There you have it! We hope this has shed some light on the pathway of being a chartered accountant after SPM. Although there will be challenges on the long and windy road, rest assured that these hurdles will equip you with the skills and knowledge that are required of a chartered accountant.