Will ChatGPT and AI Replace Accountants?

Are accountants at risk of losing their jobs to ChatGPT and AI? Here’s what you need to know about technology and the accounting profession.

Updated 23 Jun 2023

Let’s face it, artificial intelligence (AI) isn’t going anywhere. A quick scroll online and you’ll see how AI has been making waves in various industries, from customer service and retail to healthcare and finance. In fact, some reports state that AI could replace as many as 300 million jobs worldwide.

But how true is that for accounting? Do AI tools have the capability to replace the professional accountant? And how can accountants stay ahead of AI?

In this article, we explore the impact of AI and ChatGPT in the accounting field and whether studying accounting is a good choice.

What is AI and ChatGPT?

Artificial intelligence refers to intelligent computer systems that can mimic and execute tasks that are typically performed by humans. Trained on large volumes of data, these computer systems can simulate human intelligence to reason, analyse, predict, learn and solve problems.

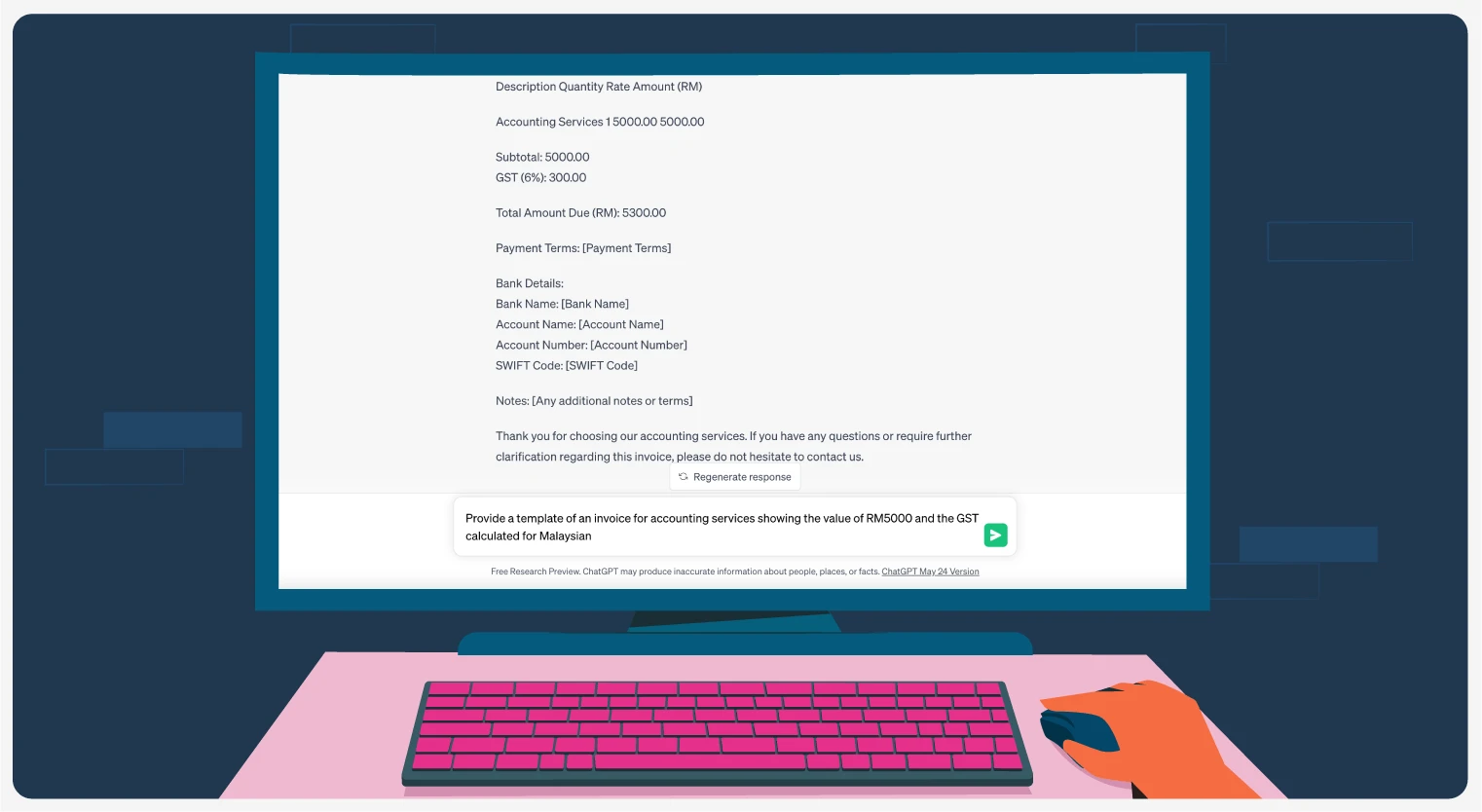

A recent AI creation that has broken the internet is ChatGPT, an AI tool which you can have human-like conversations with. Powered by natural language processing, ChatGPT can answer questions, generate text (e.g. write summaries or explanations) on a wide range of subjects, brainstorm ideas, solve mathematical problems and even write code.

Whether it’s breaking down complex scientific concepts, writing Excel formulas or creating travel itineraries for a month-long holiday in Europe, you can engage ChatGPT to assist you with a diverse array of tasks.

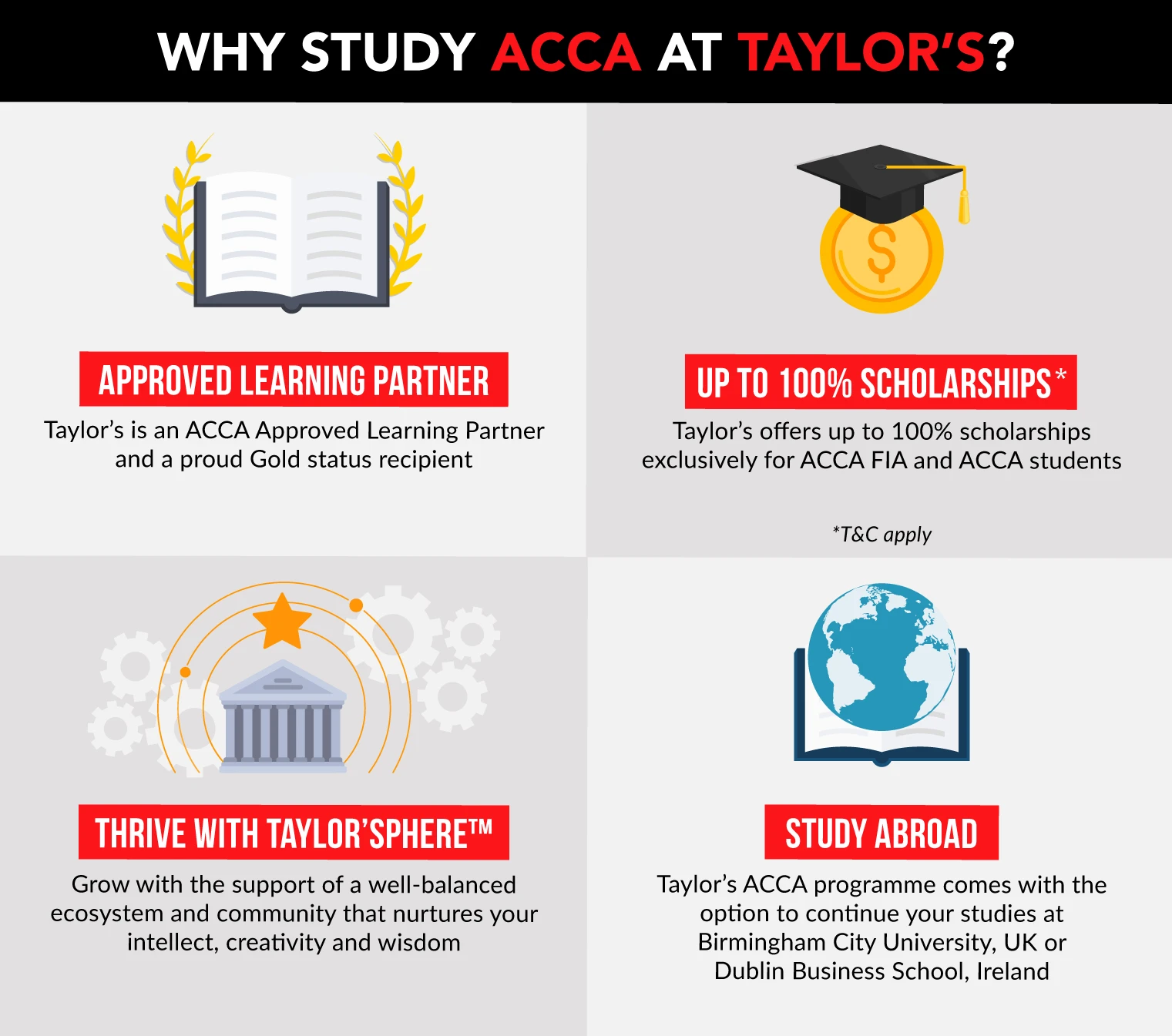

Taylor's College

Association of Chartered Certified Accountants (ACCA)

✓Platinum-status Approved Learning Partner of ACCA

How is AI being used in accounting?

Integrating AI into finance and accounting isn’t a new concept. In fact, long before the arrival of ChatGPT, AI has already been used in the field to automate routine tasks, improve accuracy, enhance data analysis and provide valuable insights.

For example, AI tools such as Dext automate the recording of financial transactions by extracting data from receipts, invoices and bank statements — all without you having to sit down and enter the data manually. Accounting software such as Xero and QuickBooks have AI working in the background to speed up bank reconciliations by predicting and suggesting matches.

That’s not all. There are also AI-powered solutions such as MindBridge that use machine learning and statistical methods to detect anomalies in financial data, identifying suspicious patterns and unusual transactions so that they can be investigated quickly.

All of these tools not only help businesses save time, reduce errors and improve efficiency, but also allow accounting professionals to focus on more complex tasks that they might not otherwise have time for.

PRO TIP

With AI, it’s more crucial than ever to stay on your toes with a professional accounting qualification like ACCA. It keeps you current with the latest industry news, ensures compliance with evolving regulations, facilitates working globally, and positions you to provide highly-valued services. Learn how you can study ACCA at Taylor’s College.

Can ChatGPT replace accountants?

ChatGPT has gained a lot of attention with its advanced capabilities to simulate human-like responses and generate coherent and relevant information. This includes providing customer support, creating content, translating languages and brainstorming ideas, all within seconds.

Furthermore, with the latest GPT-4 model, the tool has even passed numerous exams including the bar exam and the medical licensing examination in the US, the Wharton’s School of Business MBA exams, and even the Sommelier examinations which are known to be notoriously difficult.

Does that mean it’s poised to replace accounting professionals? The short answer is no.

While ChatGPT and other AI technologies have made significant advancements, accountants are still needed to deal with complex financial scenarios that require critical thinking, professional judgement and decision-making.

Here are some of the things ChatGPT cannot do and why accountants are still needed.

#1. ChatGPT may provide answers that seem correct but actually aren’t

ChatGPT is ultimately a language model designed to generate human-like responses based on the input it receives. As such, it can generate responses that may seem plausible but are factually incorrect, commonly referred to as "hallucination”.

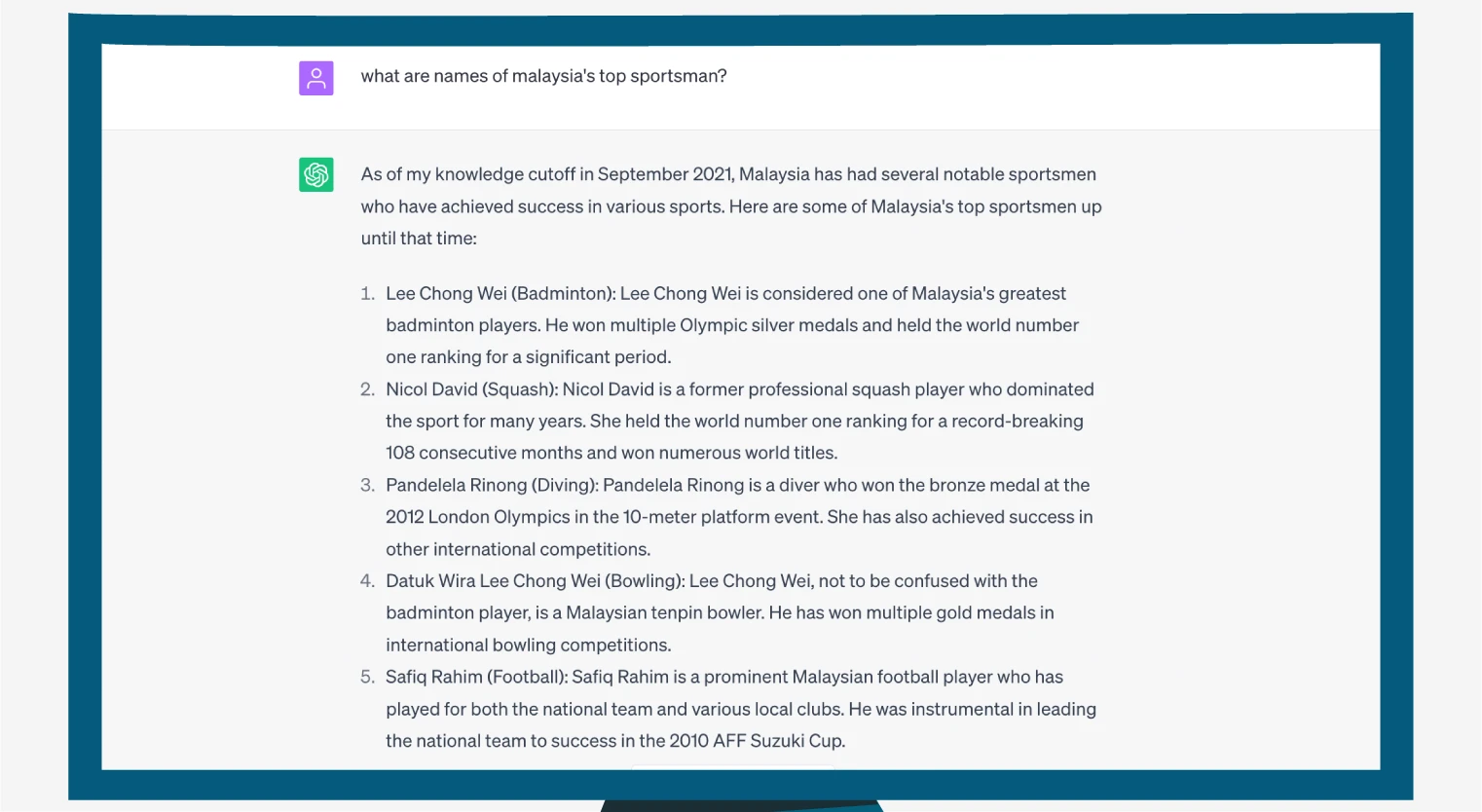

A perfect example to illustrate hallucination in ChatGPT is the case of a lawyer who used the chatbot to reference past cases in a court filing and the cases turned out to be completely made up. Or take this question about the top athletes in Malaysia where it has mistakenly invented a fictitious tenpin bowler.

In accounting, accuracy is key and has a huge impact on the financial health of businesses. A small error in financial reports can lead to serious losses and legal issues. A professional accountant is needed to analyse financial data, interpret regulations and assess the impact on business operations. These tasks involve a deep understanding of accounting principles, tax laws and industry-specific regulations, which AI may struggle to replicate accurately.

Taylor's College

Association of Chartered Certified Accountants (ACCA)

✓Platinum-status Approved Learning Partner of ACCA

#2. ChatGPT lacks a deep understanding of context

In an accounting trial balance test provided to ChatGPT, it failed to process the word “advance” despite correctly categorising a similar word “advances” earlier on. In a real-world setting, a human would have been able to identify it correctly based on the context and nature of the account balance.

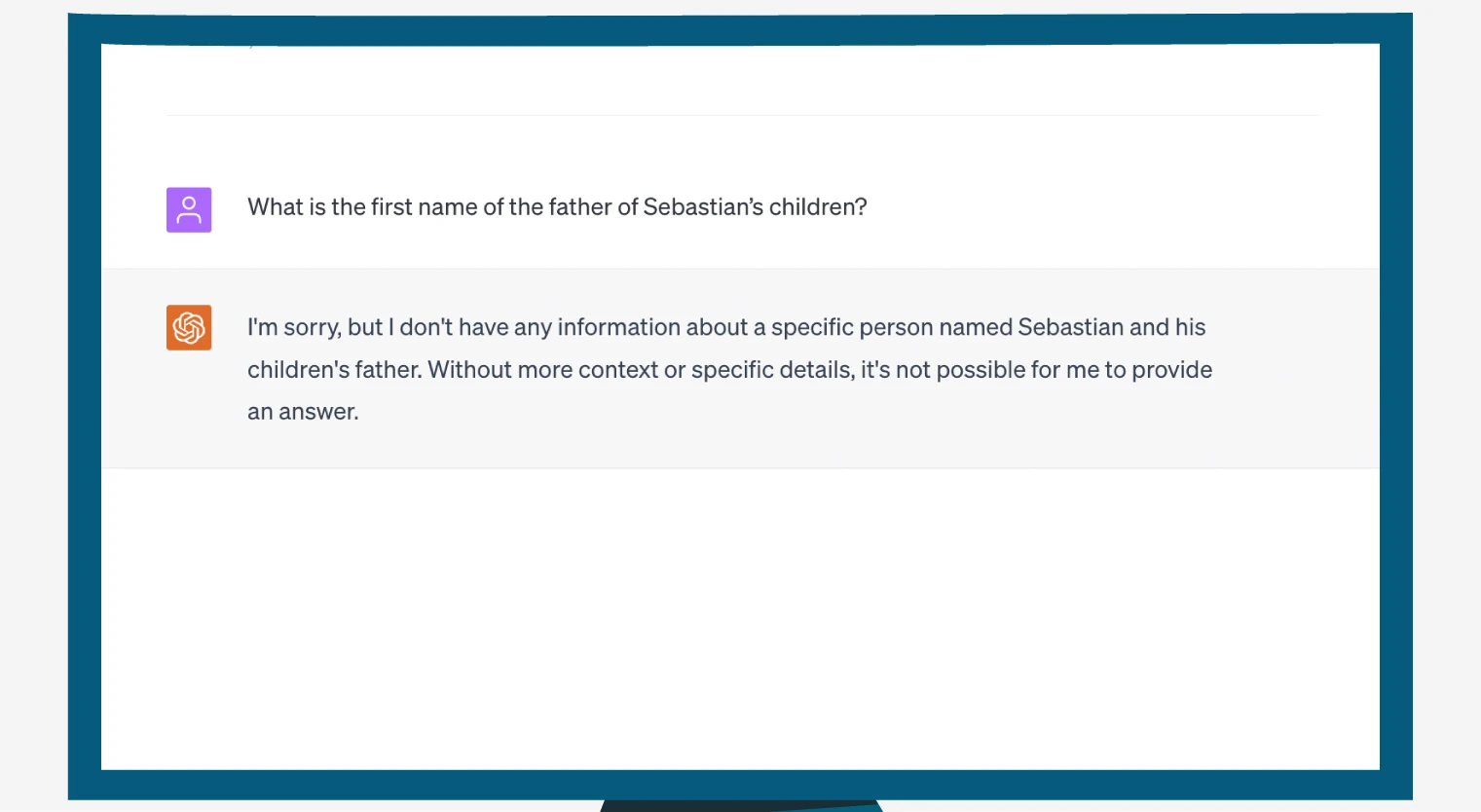

Another plain example of how it fails to grasp nuances is if the prompt has hints of sarcasm, irony or if it’s a riddle.

This is because, as a language model, ChatGPT does not possess intelligence in the way humans do. Instead, its ability to process information is based on patterns and statistical associations. Therefore, unless you elaborate or provide it with specifics, it won’t be able to make a judgement based on contextual factors.

As such, accounting professionals are needed as they possess an innate ability to sense and interpret subtle cues and context easily. Through their expertise and judgement, they can apply the information appropriately based on the specific needs and situations of their clients.

#3. Accounting professionals do more than log debit and credit entries

Beyond bookkeeping and filing taxes, accountants perform a wide range of crucial responsibilities that contribute to the financial health and decision-making of organisations.

For starters, accountants often serve as trusted advisors, providing professional guidance to clients or internal stakeholders. They analyse financial data, interpret trends and offer insights on business strategies, growth and risk management. This requires human reasoning and critical thinking abilities that go beyond the capabilities of AI.

Moreover, rather than being desk-bound, accounting professionals work and collaborate closely with clients. Establishing trust, understanding client objectives and goals, and addressing concerns require human empathy and communication skills, all of which cannot be easily replicated by AI.

Finally, accountants have an obligation to maintain professional integrity, objectivity and confidentiality. When it comes to moral and ethical dilemmas, these often involve subjective judgements that may not align well with AI.

In essence, an accountant’s expertise expands beyond calculators and ledgers. While AI can improve efficiency and support accountants in their work, the unique combination of human skills, expertise and professional judgement remains an essential part of the field.

PRO TIP

With ACCA, you can ensure you're staying at the forefront of the accounting profession. ACCA offers an Ethics and Professional Skills module that covers a range of themes such as innovation and scepticism, leadership and team working, and commercial awareness, making you a well-rounded and skilled accountant whose expertise spans beyond numbers. Start your ACCA journey with up to 35% fee waiver at Taylor’s.

So, does it mean it’s safe to study accounting?

While AI can automate certain tasks, it cannot replace the need for human accountants. From managing relationships and crafting strategy to critical thinking and ethical decision-making, accounting professionals bring a unique blend of skills that simply cannot be replicated by AI.

That said, you must equip yourself with key skills to stay relevant in the industry.

To start, you’ll need to embrace AI to supplement your capabilities instead of seeing them as a threat. Being familiar with the various AI software allows you to automate all the routine and repetitive tasks and use your skills in areas that matter such as enhancing your interpersonal and analytical skills to focus on building client relationships, communicating insights to stakeholders and influencing decision-makers.

In addition, merely knowing how to crunch numbers won’t cut it anymore. Accountants are encouraged to possess the business acumen to provide valuable insights into industry trends and market dynamics. This means being able to identify opportunities, assess potential risks, analyse cost structures and think out of the box on how the business can profit in the long run.

More importantly, enhance your technical knowledge and skills by picking up a professional accounting certification such as ACCA, ICAEW or CPA to stay updated on the latest accounting standards and regulations. Not only will these globally recognised certifications give you the credibility to be a cut above the rest, but possessing them demonstrates a high standard of technical knowledge, continuous learning and ethical conduct that’s highly valued in the accounting field.

That’s because professional accounting certificates include comprehensive and up-to-date industry-level modules to ensure accountants are able to navigate complex financial issues and changes in accounting practices. With this certification, you don’t have to worry about being replaced by an AI.

PRO TIP

Want to take a step further? Gaining international exposure can enhance your employability. At Taylor's, you can get access to award-winning universities through its transfer option to Birmingham City University, UK or Dublin Business School, Ireland in your 3rd year. Click here to learn more.

AI may be advancing across various industries at an alarming rate but it can’t strip professional accountants of their roles! With the right skills and technical knowledge, you’ll be able to make big moves and mark your place in the industry easily.

Why Study ACCA at Taylor's College?