The Complete Guide to Studying Actuarial Science in Malaysia

Wonder what are the career opportunities for actuarial science graduatues? From university to industry, learn the pathway to becoming an actuary here.

Do you absolutely love mathematics, especially probability and statistics? Want to pursue a challenging course related to numbers? Does actuarial science pique your interest? Well, this guide will show you everything you need to know about studying actuarial science in Malaysia.

Learn about what actuarial science is all about, find out how you can become an actuary and see which are the best actuarial science universities in Malaysia.

Ready to put your excellent mathematics and problem-solving skills to good use? Read on to learn more about this intellectually demanding yet rewarding course!

Asia Pacific University of Technology & Innovation (APU)

Bachelor of Science (Honours) in Actuarial Studies

✓Full accreditiation from IFoA with the maximum exemptions of 6 papers in the new IFoA curriculum

#1. What Is Actuarial Science?

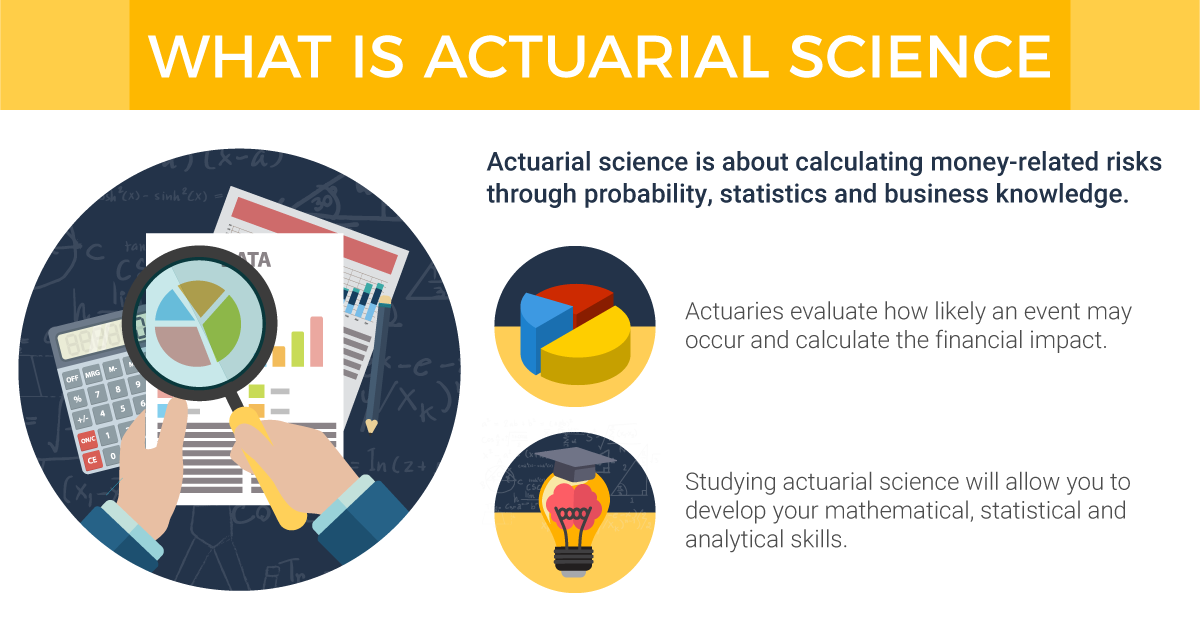

Actuarial science is about calculating money-related risks through probability, statistics and business knowledge. It is often used in the fields of insurance and finance to manage risk and make solid business and budgetary decisions.

Actuarial science is about calculating money-related risks through probability, statistics and business knowledge. It is often used in the fields of insurance and finance to manage risk and make solid business and budgetary decisions.

For example, if you have an insurance plan, you may be wondering how insurance companies can make money if you make a claim that’s more than your insurance premium (the amount you pay for your insurance policy).

Well, it is the work of an actuary! Actuaries evaluate how likely an event may occur and calculate the financial impact. In the above instance, they make calculations to ensure the total premiums collected exceeds the amount of claims made. This is how insurance companies will be able to pay out insurance claims in the event something bad happens.

Studying actuarial science will allow you to develop your mathematical, statistical and analytical skills. Risk management will be your forte, where you will learn how to assess the likelihood of future events and decrease the impact of undesirable events. These skills will be crucial in your journey to become a qualified actuary.

#2. Actuarial Science Entry Requirements

a) What subjects are needed to study actuarial science?

To study actuarial science, the required subject for SPM or equivalent is Mathematics.

As for A-Level, STPM or equivalent, the required subject is Mathematics as well. However, studying Further Mathematics, Economics or Physics would be useful.

b) Actuarial Science Degree requirements

To pursue a Degree in Actuarial Science, you need to complete a pre-university programme and meet the entry requirements.

- A-Level: Minimum of 2Ds including Mathematics

- STPM: Minimum of 2Cs including Mathematics

- Foundation in Arts or Science: Minimum CGPA of 2.00

- Diploma: Minimum CGPA 2.00

You will also need a C in Mathematics at SPM level. In addition, some universities may require you to score well in an English proficiency test such as IELTS.

#3. Studying Actuarial Science in Malaysia

a) What do you study in actuarial science?

When studying an Actuarial Science Degree, you’ll learn plenty of subjects that involve applying mathematical and statistical techniques.

Here are some of the subjects you may learn in actuarial studies:

- Probability & Statistics

- Calculus

- Introductory Economics

- Life Contingencies

- Risk Theory

- Survival Analysis

- Loss Models

- Risk Management and Insurance

This degree involves a lot of calculations and problem-solving. Therefore, you must be proficient in mathematics, especially statistics.

By the end of your Actuarial Science Degree, you will have in-depth knowledge on assessing risks and how you can minimise the costs associated with these risks.

b) How long is an Actuarial Science Degree?

A Degree in Actuarial Science is usually 3 years long.

However, you can’t call yourself an actuary just yet. Graduating with an undergraduate Degree in Actuarial Science does not mean that you are a qualified actuary.

In order to be a certified actuary, you will need to further your studies by taking professional exams with professional bodies such as the Society of Actuaries (SOA) or the Institute and Faculty of Actuaries (IFoA). The process of becoming a certified actuary can be 3 – 7 years long.

c) How much does it cost to study actuarial science in Malaysia?

An actuarial science degree can cost from RM42,000 to RM132,000.

Asia Pacific University of Technology & Innovation (APU)

APU Foundation Programme (Business & Finance & Psychology)

✓Direct pathway into dual-award degrees at APU

d) Professional actuarial bodies

To achieve professional status as an actuary, you will need to pass a set of exams. This is similar to how accountants pursue professional accounting qualifications such as ACCA.

Here are some of the most popular professional actuarial bodies in Malaysia:

- Society of Actuaries (SOA), USA

- Institute and Faculty of Actuaries (IFoA), UK

- Casualty Actuarial Society (CAS), USA

- Institute of Actuaries of Australia

- Canadian Institute of Actuaries, Canada

#4. How to Become an Actuary in Malaysia

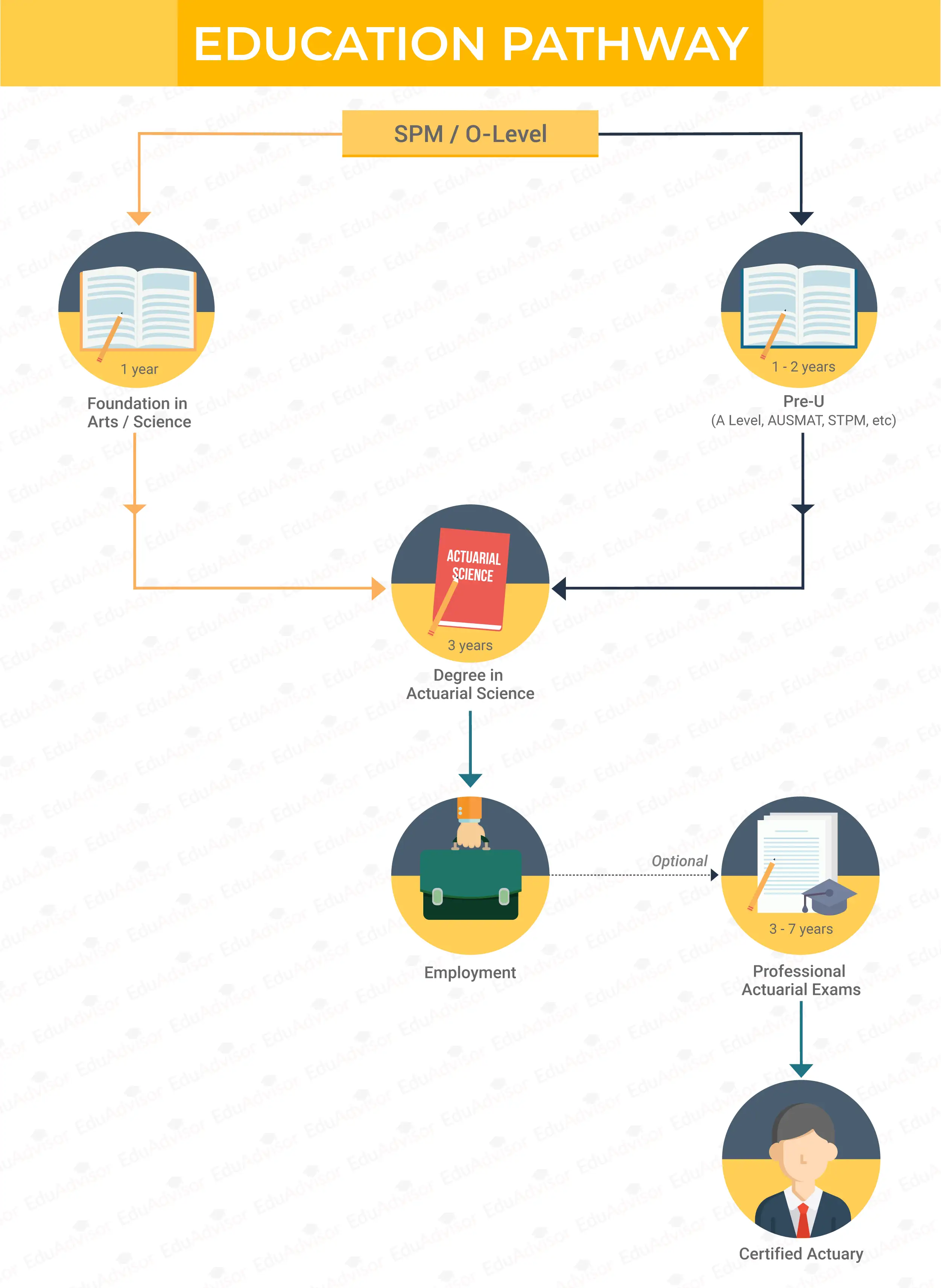

How long does it take to become an actuary? Completing an Actuarial Science Degree does not take long. However, the road to becoming a professional actuary can be lengthy. These are the steps you’ll need to take.

Step 1: First, complete a pre-university (e.g. A-Level, STPM) or Foundation course after SPM. This will typically take 1 – 2 years depending on the selected programme.

Step 2: Subsequently, complete your Actuarial Science Degree, which is usually 3 years. Completing this degree will allow you to enter the workforce. However, you are not considered a certified actuary yet.

Step 3: In order to achieve professional status as an actuary, you will need to further your actuarial studies by taking professional exams from bodies such as SOA and IFoA. Most people will work in the actuarial field while completing their professional papers, which may take approximately 3 – 7 years part-time.

In summary, it takes about 7 – 11 years from SPM to become a certified actuary.

PRO TIP

Some Actuarial Science Degrees will offer subjects that can give you exemptions for your professional papers. Check with your university to find out what exemptions you can get.

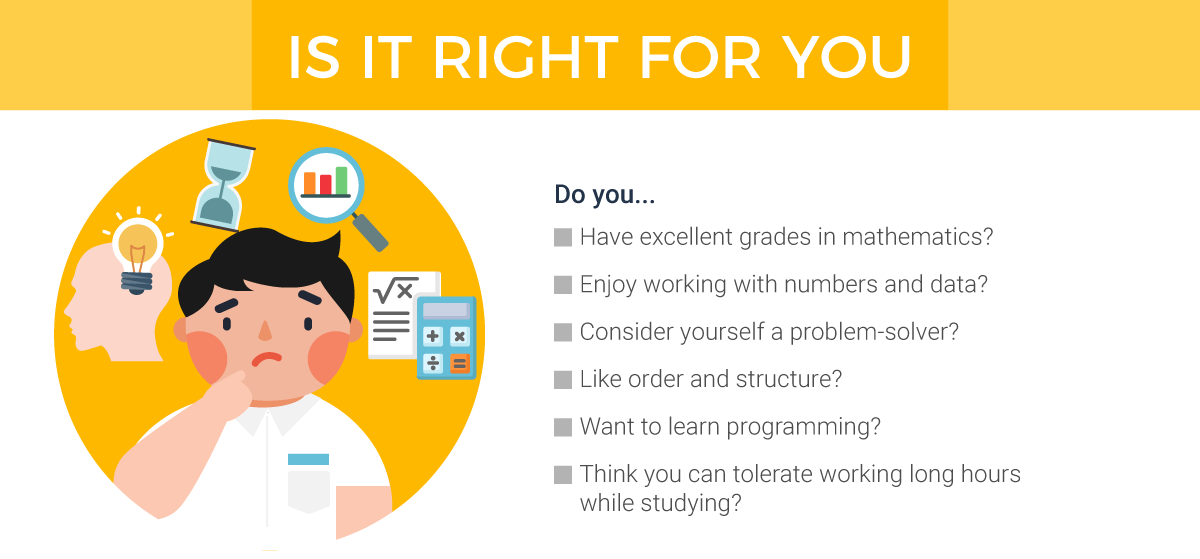

#5. Should You Study Actuarial Science?

a) Is actuarial science the right course for you?

There are plenty of reasons why actuarial science is a great degree. However, it is an intellectually demanding course. Before you decide to jump in, take a moment to consider if you agree with these questions:

- Are you good at mathematics?

- Do you have a passion for working with numbers and data?

- Are you a problem-solver?

- Do you like order and structure?

- Will you be interested in learning programming?

- Can you tolerate working long hours while studying for your professional exams?

If you answered yes to most of these questions, actuarial studies could be the right course for you!

Asia Pacific University of Technology & Innovation (APU)

Bachelor of Science (Honours) in Actuarial Studies

✓Full accreditiation from IFoA with the maximum exemptions of 6 papers in the new IFoA curriculum

b) Skills required to be an actuary

These are a few essential skills a good actuary should have:

- Strong foundation in mathematics, especially statistics, probability and calculus

- Good problem-solving skills

- Excellent communication skills to convey complex information

- Strong computing skills to build spreadsheet models and use statistical analysis programs

- Ability to work well with others

#6. What Can You Do With an Actuarial Science Degree in Malaysia?

Once you’ve completed a Degree in Actuarial Science, you’ll be able to pursue a career in companies that specialise in insurance, banking, finance and business consultancy. At the same time, there are also career opportunities in the digital space due to big data analytics.

Here’s a preview of the careers you can expect to pursue upon graduating:

- Risk Analyst

- Insurance Actuarial Analyst

- Actuarial Consultant

- Business Analyst

- Investment Analyst

- Underwriter

- Data Scientist

Do note that to work as a qualified actuary in more senior roles, you’ll need to complete your professional exams. You can do this part-time while you’re working.

Asia Pacific University of Technology & Innovation (APU)

APU Foundation Programme (Business & Finance & Psychology)

✓Direct pathway into dual-award degrees at APU

#7. Best Actuarial Science Universities in Malaysia

If you’ve decided that the fascinating field of actuarial science is perfect for you, check out some of the best universities for actuarial science in Malaysia. Alternatively, compare more universities for actuarial science here.

Asia Pacific University of Technology & Innovation (APU)

Bukit Jalil, Kuala Lumpur

Bachelor of Science (Honours) in Actuarial Studies

Intake

Mar, Jul, Sep, Nov

Tuition Fees

RM92,000

Malaysia's award-winning Premier Digital Tech University