The Complete Guide to Studying FinTech in Malaysia

What is in a FinTech course? Explore the programme, its entry requirements, fees and more in this comprehensive programme guide.

Have you ever used online banking or QR pay? Shopped on online sites like Shopee or Lazada? Heard about the explosive growth of cryptocurrencies like Bitcoin and Ethereum?

The world as we know it today is shaped by fintech. But what exactly is fintech? And how does it differ from traditional finance?

This guide will provide you insight into fintech including what it is, what you will learn, the best fintech programmes in Malaysia and job prospects in the field.

So if you’re thinking about studying fintech (and really, why shouldn’t you?), keep reading.

Monash University Malaysia

Bachelor of Business and Commerce - Financial Technology (FinTech)

✓Ranked #41 in the world for Accounting and Finance (QS World University Rankings by Subject 2025)

#1. What is FinTech?

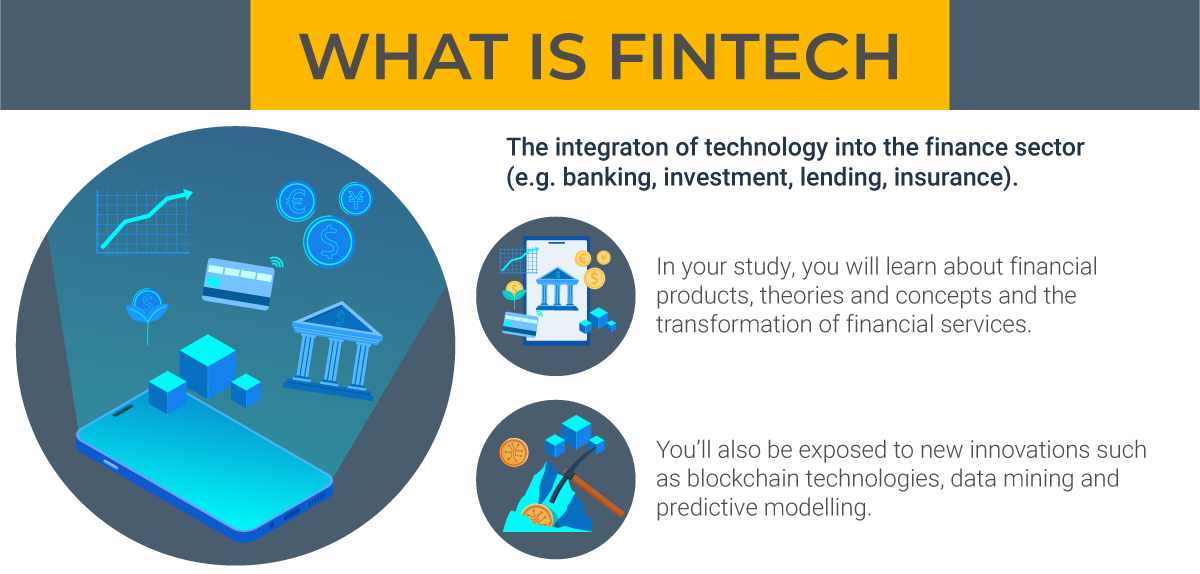

Short for financial technology, fintech is about the integration of technology into the finance sector (e.g. banking, investment, lending, insurance). The term covers many different areas, but often, it refers to any software, application or algorithm that digitalises, automates or streamlines traditional financial services. Fintech may sound a bit technical to you but it isn’t just for those working in finance. Online banking, e-wallets, roboadvisors and cryptocurrencies are just some of the many examples of how integral it is to your life now. If you have a smartphone, it’s highly likely that you’ve used fintech before.

By pursuing an education in fintech, you will learn about financial products, theories and concepts and how technology is transforming the delivery of financial services. You’ll also be exposed to new innovations in the banking and finance sector such as blockchain technologies, data mining and predictive modelling.

#2. Entry Requirements for FinTech

a) Subjects required to study fintech

To pursue a tertiary education in fintech, you must have studied the following subject for SPM or equivalent:

- Mathematics

- English

b) Requirements for Diploma in FinTech

To study a Diploma in FinTech, you must meet the following entry requirements:

- SPM (or equivalent): Minimum 3Cs including a credit in Mathematics and a pass in English

c) Requirements for Degree in FinTech

To pursue a Degree in FinTech, you need to complete a pre-university programme and meet the entry requirements.

- A Levels: Minimum 2Ds

- STPM: Minimum 2C+s

- Foundation in Business: Minimum CGPA of 2.50

- Diploma: Minimum CGPA of 2.50

In addition to the above, you are also required to have a credit in Mathematics and a pass in English at SPM or equivalent.

#3. Studying a FinTech Course

a) What subjects will you study in fintech?

Fintech is a relatively new study field in the Malaysian education system. As such, you will often find it offered as a specialisation alongside a finance or business programme.

As part of your fintech studies, you will study finance and business-related modules that will give you a solid understanding of financial concepts, markets and systems. You’ll also learn about the various new technological innovations in finance. On top of that, you will also acquire technical skills such as quantitative finance skills and computer programming skills.

Here are some of the subjects you may encounter during your studies:

- Financial accounting

- Macroeconomics and microeconomics

- Financial derivatives

- Corporate finance

- Financial modelling

- Programming for fintech

- Data analytics, mining and machine learning

- Blockchain technologies and digital currencies

- Crowdfunding

- Technopreneurship

As part of your undergraduate degree, you will also need to undergo an internship or industrial attachment to gain work experience in the industry.

b) How long is a fintech course?

A Diploma in FinTech will take approximately 2 years to complete.

As for a Degree in FinTech, the duration of your studies will be about 3 years.

c) How much does it cost to study fintech in Malaysia?

A Diploma in FinTech costs around RM11,700 to RM43,000.

A Degree in FinTech, on the other hand, is approximately RM34,650 to RM121,500.

Monash University Malaysia

Bachelor of Business and Commerce - Financial Technology (FinTech)

✓Ranked #41 in the world for Accounting and Finance (QS World University Rankings by Subject 2025)

#4. Your Education Pathway for FinTech

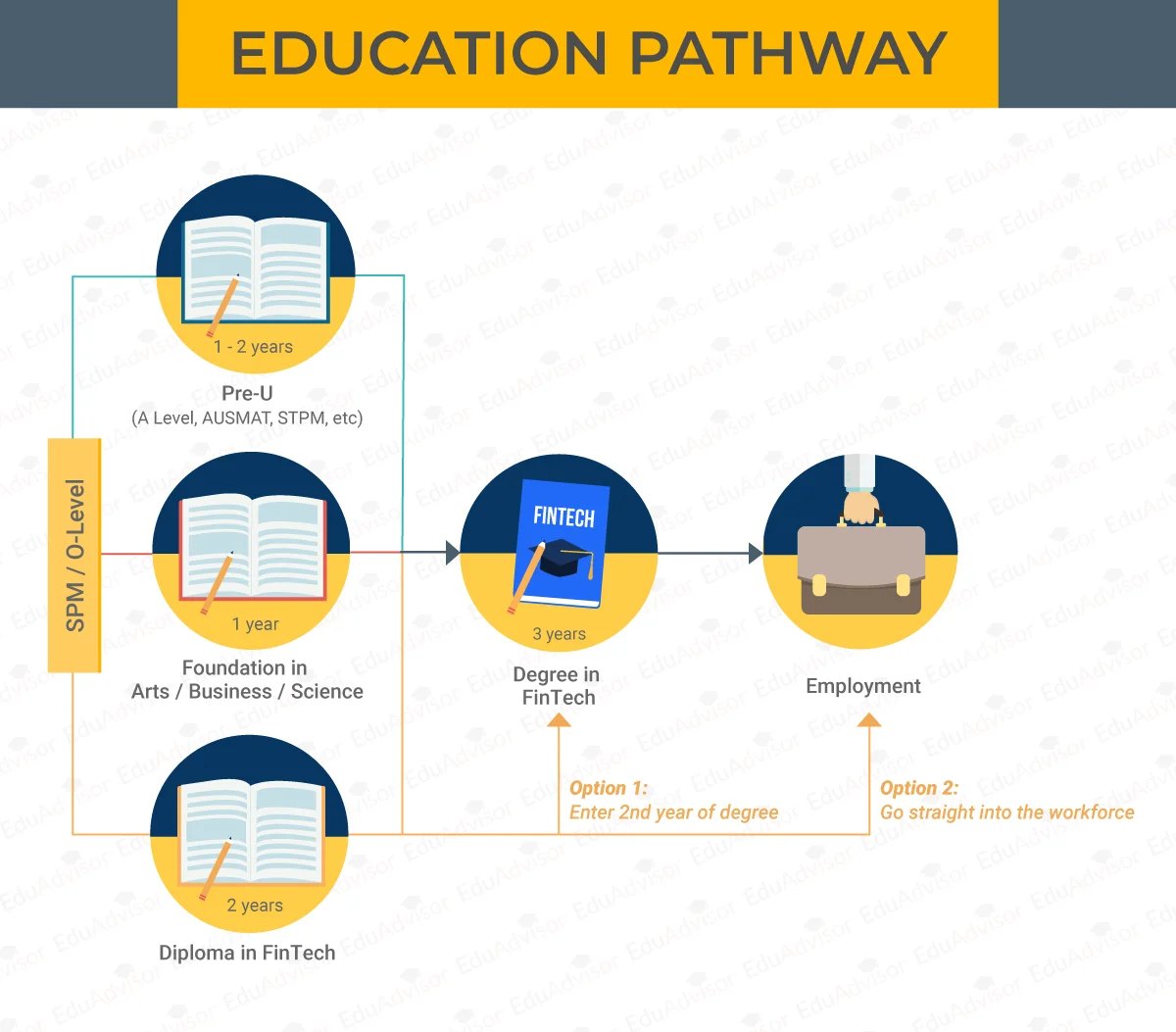

First, upon completing your SPM or equivalent qualification, you can start your fintech journey by enrolling into a pre-university (e.g. A Levels, STPM) or foundation programme (Foundation in Business, Foundation in Arts or even Foundation in Science).

With a pre-university or foundation qualification, you will be eligible to pursue a Degree in FinTech.

Alternatively, you can choose to take up a Diploma in FinTech instead after SPM. A diploma qualification will give you the option of either entering the workforce upon graduating or continuing with a Degree in FinTech, entering the second year.

#5. Should You Study FinTech?

a) Is fintech right for you?

a) Is fintech right for you?

If you’re wondering whether you should study fintech, here are some questions to think about:

- Do you consider yourself to be an analytical person?

- Are you good with numbers and data?

- Do you have a keen interest in the financial world?

- Do you consider yourself to be technologically savvy?

- Are you comfortable with picking up programming?

- How well can you adapt to constant technological changes?

If you answered yes to most of these questions, fintech may be right for you!

b) Skills required to work in the fintech field

Here are some key skills a good fintech professional should have:

- An in-depth and up-to-date knowledge on trends and development in the finance world

- A meticulous eye for detail

- An analytical and critical mind

- Knowledge on how to parse through information and form an analysis

- A working knowledge in technology

- A passion for solving complex problems

- Ability to work under pressure

- Good communication skills

Monash University Malaysia

Bachelor of Business and Commerce - Financial Technology (FinTech)

✓Ranked #41 in the world for Accounting and Finance (QS World University Rankings by Subject 2025)

#6. Career Options in FinTech

With the rise of technology and data analytics in the finance industry, there is a growing demand for professionals with cross-discipline knowledge and skills in finance and technology.

With a qualification in fintech, you can seek employment opportunities in various fintech companies. This includes digital banks and e-wallet companies, crowdfunding platforms, roboadvisors and cryptocurrency firms.

Here are some careers you can pursue with background in fintech:

- Financial Analyst

- Payment System Specialist

- Data Analyst

- Product Manager

- Quantitative Analyst

- Strategy Analyst

- App Developer

- Blockchain Developer

- Cybersecurity Analyst

- FinTech Quantitative Developer

- FinTech Systems Analyst

- FinTech Specialist

#7. Best Universities for FinTech in Malaysia

If you’re interested in fintech, here are some of the best colleges and universities for fintech in Malaysia.

Monash University Malaysia

Bandar Sunway, Selangor

Bachelor of Business and Commerce - Financial Technology (FinTech)

Intake

Feb, Jul, Oct

Tuition Fees

RM132,480

Get RM100 Waiver + RM300 Rebate when you enrol through EduAdvisor! T&C apply.

a) Is fintech right for you?

a) Is fintech right for you?