FinTech As the New Normal in the Finance Industry, and How APU Is Standing Out

Financial technology (FinTech) is shaping the future of financial services and APU can help you reach it. Learn more about it here.

Published 30 Jul 2021

As the 21st century calls for the 4th Industrial Revolution, we can see more of technology being seamed into the fabric of our lives and changing how we live, work and communicate. The clearest example is how e-wallets and digital payments are becoming the new form of payment.

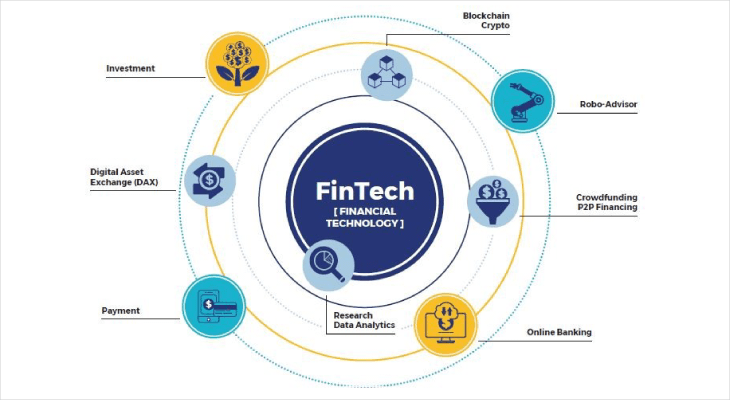

Thanks to financial technology (FinTech) which embodies IR4.0 technologies such as blockchain, artificial intelligence (AI) and data analytics, people are able to have a seamless and secured experience in going about their daily lives during the pandemic.

While FinTech offers solutions, this phenomenon also signifies that accounting and finance professionals have to embrace rapid transformation and adapt to technological advancements. According to a research conducted by the University of Oxford, accountants are more likely to be affected by the emergence of AI technologies.

This calls for immediate upskilling in strategic knowledge and technical skills for financial professionals to take on new roles such as FinTech specialists and business data analysts within the industry. According to the National Policy on Industry 4.0, FinTech is listed as one of the areas that require talents to transform the country’s digital economy.

Apart from the Government encouraging the masses to use e-wallets through the e-Tunai Rakyat under Budget 2020, Bank Negara announced in 2018 its plans to issue up to five licences for digital banking within the country to encourage industry players of the financial sector to put innovative technologies into use. The need for talents in FinTech who possess the necessary skills and knowledge has become even more critical.

The APU advantage – infusing IR4.0 into Programmes

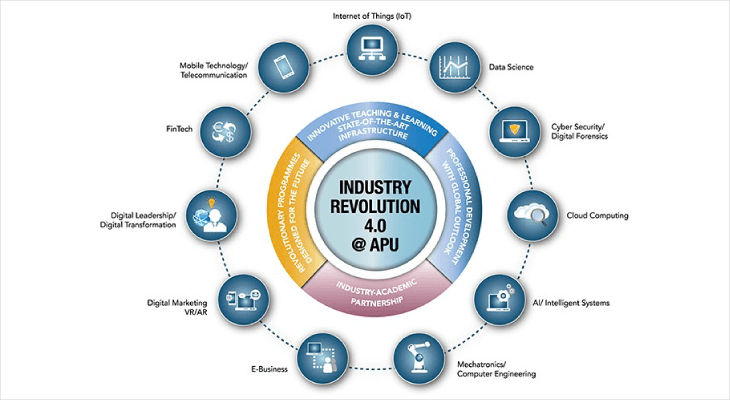

As one of Malaysia’s highest rated Premier Digital Tech Universities that established its own IR4.0 strategy, Asia Pacific University of Technology and Innovation (APU) has formed an ecosystem that facilitates the delivery of IR4.0-relevant programmes infusing key technologies such as data science, cybersecurity and digital forensics, e-business, and AI / intelligent systems.

As part of this ecosystem, FinTech education is integrated into the accounting, banking and finance disciplines, powered by concepts and applications of blockchain technology, Robo advisory, FinTech governance and risk management, digital currencies and cryptocurrencies and crowdfunding. The exposure to specific FinTech modules ensures that students are not alienated by the rapid transformation happening around the financial sector when they graduate.

Pioneering FinTech programmes

For school leavers and future IT professionals, APU offers Malaysia’s first academic programme in FinTech – the Bachelor of Banking of Finance (Hons) with a specialism in Financial Technology, in addition to the BSc (Hons) Information Technology with a specialism in Financial Technology - FinTech.

With the recent launch of the Master of Finance with a specialism in FinTech postgraduate programme, career professionals can now stay relevant and keep up with cutting edge disruptive technologies, which are prevalent within the financial sector.

In fact, APU’s FinTech education was established together with the industry. The first FinTech academic degree in Malaysia offered by APU was built in collaboration with SuperCharger, Asia’s leading FinTech accelerator through an agreement in 2018. It was aimed to leverage local opportunities as well as to address the talent needs of Malaysian FinTech and banktech institutions that are facing a talent shortage.

Career and Internship Opportunities in FinTech

APU also became the first and only university to sign a pact with the FinTech Association of Malaysia (FAOM) in March 2020. This partnership opens a window of opportunity for APU FinTech students who will be exposed to career and internship opportunities with over 80 members of FOAM, which include leading banks, financial institutions and FinTech platforms. This will provide them with relevant industry exposure before graduating from university.

Not only that, industry experts from FAOM will also provide inputs in enhancing the programme to comprise key areas of FinTech — namely digital currencies, blockchain technologies, crowdfunding, robo-advisory and entrepreneurial finance.

According to the latest Annual Graduate Tracer Study by the Higher Education Ministry, 100% of APU graduates were employed upon graduation. This is a significant symbol of APU’s success and pride in nurturing professionals for global careers.

APU School of Accounting and Finance

APU’s School of Accounting and Finance is headed by Prof Dr Nafis Alam — the only one from Malaysia and one of six from the Asia Pacific region — to be featured in the top 100 social media influencers shaping the conversation in FinTech. Prof Nafis, who has recently published a book on FinTech and Islamic finance, has extensive engagement with the industry and FinTech circle which will further boost the delivery of the programme.

Change the game in the financial industry by taking up a degree at Asia Pacific University! Leave your details to learn more.

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Registration Waivers, Discounts and Rebates: EduAdvisor students often enjoy additional waivers, discounts and rebates during registration due to our close relationship with universities.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Registration Fee Waiver: A 100% registration fee waiver is available for all EduAdvisor students using this waiver code — AGE24

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Head over to: https://www.rumc.edu.my/apply-now/

Remember to use the following waiver code to be eligible for a 100% waiver on the application fee and our EduAdvisor Registration Reward: AGE24

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Head over to: https://admission.unikl.edu.my/online/frmHome.php

Remember to use the following public agent code to be eligible for our EduAdvisor Registration Reward: PA0001

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Head over to: https://application.mmu.edu.my/

Select “Agent ID”, fill in the EduAdvisor agent code: AG0000409 and select Distinctive Education Advisor to be eligible for our EduAdvisor Registration Reward.

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Head over to: https://oculus.uts.edu.my/apply/signup.php

Remember to use the following agent ID to be eligible for our EduAdvisor Registration Reward: DEA

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Registration Fee Waiver: A 50% registration fee waiver is available for EduAdvisor students during selected UCSI events.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Head over to UCSI’s website here.

Remember to use the following agent code to be eligible for our EduAdvisor Registration Reward: 779700

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Registration Fee Waiver: A 50% registration fee waiver is available for EduAdvisor students during selected UCSI events.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Head over to UCSI’s website here.

Remember to use the following agent code to be eligible for our EduAdvisor Registration Reward: 100023

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Tuition Fee Rebate: A RM1,500 tuition fee rebate is available for EduAdvisor students during selected NUMed events.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Head over to: https://application.newcastle.edu.my/registration?ref=1652487az1ydp0i

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Head over to: https://intake.utmspace.edu.my/refer/63c50d45156c8

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Early Bird Waiver: A waiver of RM1,000 is available for all EduAdvisor students enrolling in this programme. T&C applies.

- Edu Assist: A tuition fee waiver of up to 35% is available for students that are from low income family. T&C applies.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- RM500 Rebate: A rebate of RM500 is available for all EduAdvisor students enrolling in this programme.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Registration Bursary: A further discount of RM1,000 is available for eligible students enrolling in this programme.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Open Day Waiver: A further waiver of RM450 to RM800 is available for eligible students enrolling in this programme during IMU's Open Day events.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Application Fee Waiver: A RM100 application fee waiver code is available for EduAdvisor students during selected Monash events.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Registration Fee Rebate: A registration fee rebate of up to RM1,000 is available for EduAdvisor students enrolling in this programme.

- Early Bird Waiver: An early bird waiver of RM1,500 is available for EduAdvisor students enrolling in this programme for the July 2024 intake.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Early Bird / Event Day Waiver: A fee waiver of RM500 is available for all EduAdvisor students enrolling in this programme. T&C applies.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Open Day Waiver: A application fee waiver of up to RM500 is available for all EduAdvisor students enrolling in this programme during MAHSA's Open Days.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Registration Fee Waiver: A Registration Fee Waiver of up to RM500 is available for EduAdvisor students.

- Special Tuition Fee Waiver: A further discount of RM1,000 is available for eligible EduAdvisor Students enrolling in this programme.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Registration Fee Discount: A rebate of RM500 to RM1,000 is available for EduAdvisor students enrolling in this programme.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Event Waiver: A RM500 admin fee rebate is available for all EduAdvisor students during selected UM-Wales events. T&C applies.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Registration Waiver: A rebate of RM1,000 to RM2,000 is available for EduAdvisor students enrolling in this programme.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Application Fee Waiver: A fee waiver of RM150 is available for all EduAdvisor students enrolling in this programme. T&C applies.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Open Day Rebate: A RM500 rebate is available for EduAdvisor students during MCKL's events.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Open Day Waiver: A application fee waiver of up to RM500 is available for all EduAdvisor students enrolling in this programme during MAHSA's Open Days.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Head over to: https://at.edv.my/apply-mahsa

Thank you for your enquiry

Here's what will happen next.

You’ll receive a WhatsApp confirmation from us regarding your enquiry.

Our advisors will be in touch to give you all the information you need.

Did you know all EduAdvisor students can enjoy some of the following waivers / discounts?

- Registration Waivers, Discounts and Rebates: EduAdvisor students often enjoy additional waivers, discounts and rebates during registration due to our close relationship with universities.

- EduAdvisor Registration Reward: Any student that registers through EduAdvisor (or makes an appointment to visit the university through EduAdvisor) is eligible for an extra EduAdvisor Registration Reward of RM300. T&C applies.

Start your application today via our online application form: https://eduadvisor.my/apply

Generating your application

Hang tight! This will only take 1-2 minutes...

0%

Your application form is ready

We've prepared your university application based on the details provided. Review and sign to complete your university application.

Submitting your application

Hang tight! This will only take 1-2 minutes...

0%

Your application form is submitted

Nina Fazil

A work in progress — has been for the past 24 years.