Finance vs Accounting: 5 Major Differences You Need to Know

Are you torn between a Degree in Finance and a Degree in Accounting? We shed some light on the differences between the two fields here.

Updated 17 May 2022

Accounting and finance are two of the most popular majors of a Business Degree, but are they one and the same? Can the same skills be applied in both fields and will both courses lead you to the same types of careers?

In this article, we shine the spotlight on the differences between the two so you can have a clearer picture before deciding which course to major in.

Taylor's College

ACCA Foundation in Accountancy (FIA)

✓Platinum-status Approved Learning Partner of ACCA

#1. Finance focuses on the future while accounting reports on the past

Finance professionals (e.g. financial advisor, financial planner, investment banker) are generally involved in sourcing funds (i.e. money) and investing the money to grow a company’s wealth for a future return. They ensure that a business has enough money to operate in the future through concepts such as borrowing, saving and investing.

Accounting, on the other hand, tends to look to the past, where accounting professionals track, report and analyse financial transactions of an organisation. This means recording a company’s cash flow, maintaining accounting ledgers and reporting earnings and losses, thus ensuring that past events are recorded accurately.

#2. Both have different branches you can specialise in

Just like other professions, you can choose to specialise in different domains once you graduate based on your interest.

In general, there are 3 main areas of finance — personal finance, corporate finance and public finance.

Personal finance

Relates to financial decisions that will affect an individual. Topics around personal finance often include paying for education, investing and saving for retirement, protecting against unforeseen events (e.g. purchasing insurance) and estate planning (e.g. preparation of will in case of death).

Jobs in the personal finance industry include financial planner and relationship or private wealth manager.

Corporate finance

Focuses on the financial future of an organisation and often deals with maximising the value of a business, including identifying undervalued assets for purchase, arranging of debt or loan for company expenditure and analysing a company for merger or acquisition.

Careers in this branch includes trader, financial analyst, credit analyst, investment banker and fund manager.

Public finance

Relates to allocation and management of resources at state, government or government-linked entities (e.g. Ministry of Finance, Bank Negara Malaysia, Employee Provident Fund (EPF)). It involves decision making over a longer time horizon to deliver value to the public.

Jobs in the public finance industry include valuation analyst, investment operations associate and debt/equities research analyst.

On the other hand, the key areas of accounting are financial accounting, management accounting, tax accounting and audit & assurance services.

Financial accounting

Helps businesses keep track of their overall financial health by producing detailed reports of a company’s financial transactions. Tasks include recording financial transactions and preparing reports (e.g. cash flow statement, profit and loss statement, balance sheet).

Some of the careers in financial accounting are accounts executive, accounts specialist (accounts payable/receivable) and bookkeeper.

Management accounting

Focuses on reporting and analysing financial information to help businesses make decisions to fulfil company goals and objectives. Some of the tasks under management accounting include financial forecasting, budgeting, cost allocation and cost-benefit analysis.

Jobs in this branch include management accountant, budget analyst and financial controller.

Tax accounting

Focuses on accounting methods for tax purposes. Tax accounting is governed by the guidelines set by the Inland Revenue Board (IRB) of Malaysia, which dictates specific rules that individuals and companies have to follow when submitting taxes.

Careers in tax accounting include tax consultant and tax advisor.

Auditing & assurance services

Inspects a company’s financial records to ensure that it follows proper accounting standards. Auditors evaluate the integrity of financial transactions through methods such as observing physical inventory count, reviewing invoices and payments as well as analysing variances in account balances.

Jobs in the audit industry include auditor and internal audit associate.

Apply for university with EduAdvisor

Secure scholarships and more when you apply to any of our 100+ partner universities.

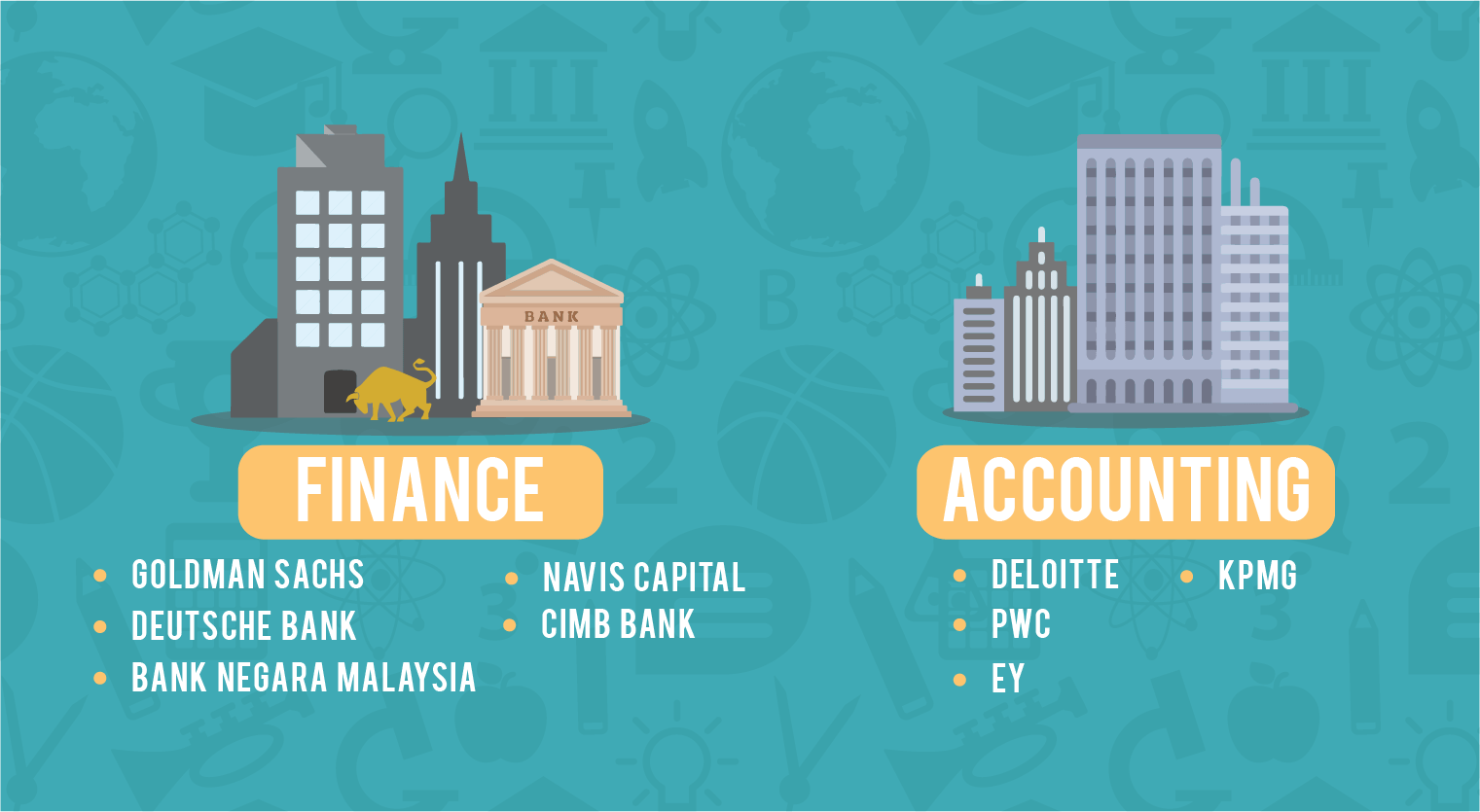

Start now#3. Your potential employers can be different

As a finance graduate, you can target your job search to investment banks (e.g. Goldman Sachs, Deutsche Bank, JPMorgan, CIMB Investment Bank), commercial banks (e.g. Maybank, CIMB Bank, Citibank), private equity firms (e.g. Creador, NAVIS Capital) and government / government-linked companies (e.g. Bank Negara Malaysia, Employees Provident Fund).

With accounting, most graduates would seek employment in the Big Four, the 4 largest accounting firms in the world, namely Deloitte, PricewaterhouseCoopers (PwC), Ernst & Young (EY) and KPMG. In addition to accounting firms, numerous companies also require the services of an accountant.

It is worth noting that all companies, large or small, need accounting professionals, whereas not every company will require a finance professional. This means that your employment options can be much wider as an accounting graduate.

Taylor's College

ACCA Foundation in Accountancy (FIA)

✓Platinum-status Approved Learning Partner of ACCA

#4. Each field has its own professional qualifications

If you’re a finance graduate, you can pursue professional qualifications such as Chartered Financial Analyst (CFA), Certified Financial Planner (CFP) and Registered Financial Planner (RFP).

On the other hand, if you plan on pursuing a professional qualification in the accountancy field, you can be accredited by a number of professional bodies, such as the Association of Chartered Certified Accountants (ACCA), Chartered Institute of Management Accountants (CIMA) and Institute of Chartered Accountants in England and Wales (ICAEW).

PRO TIP

When it comes to the finance or accounting field, having professional qualifications can increase your desirability to potential employers, thus skyrocketing your chances of getting hired and having a better salary!

#5. Some finance jobs have higher salaries than accounting

While both finance and accounting can be lucrative careers, certain areas of finance have higher salaries compared to accounting.

Take investment banking, for instance. According to the 2018/2019 Salary Guide from Kelly Services, an investment banker (a finance job) with 10-15 years of experience can earn up to RM36,000 a month. In comparison, a financial controller (an accounting job) with the same number of years of experience could earn up to RM22,000 a month — not a small sum certainly, but still 63% less than an investment banker.

However, in other areas of finance (e.g. commercial banking, priority banking, capital markets), the maximum monthly salary is approximately RM20,000 - RM23,000, which is closer to what a financial controller would earn.

So there you have it! Although both finance and accounting are intricately related, they are ultimately different fields and will set you on different career paths. Therefore, make sure you choose wisely based on your interests and career goals. Good luck!