The Complete Guide to Studying ACCA Certified Accounting Technician (CAT) in Malaysia

What is ACCA CAT and how does it connect you to ACCA? Explore the requirements, pathway and fees for ACCA CAT in this comprehensive guide.

This is a comprehensive guide to studying the Certified Accounting Technician (CAT) programme in Malaysia.

In this guide, you will gain a detailed understanding about what CAT is all about, including how you can progress from CAT to ACCA, what ACCA exemptions you can get with a CAT qualification and the best colleges and universities in Malaysia to study CAT.

As accountants play an integral role in businesses, it is crucial for them to be certified and recognised at a professional level. So, read on to find out more about studying CAT accounting in Malaysia and how it can elevate your career as an accountant.

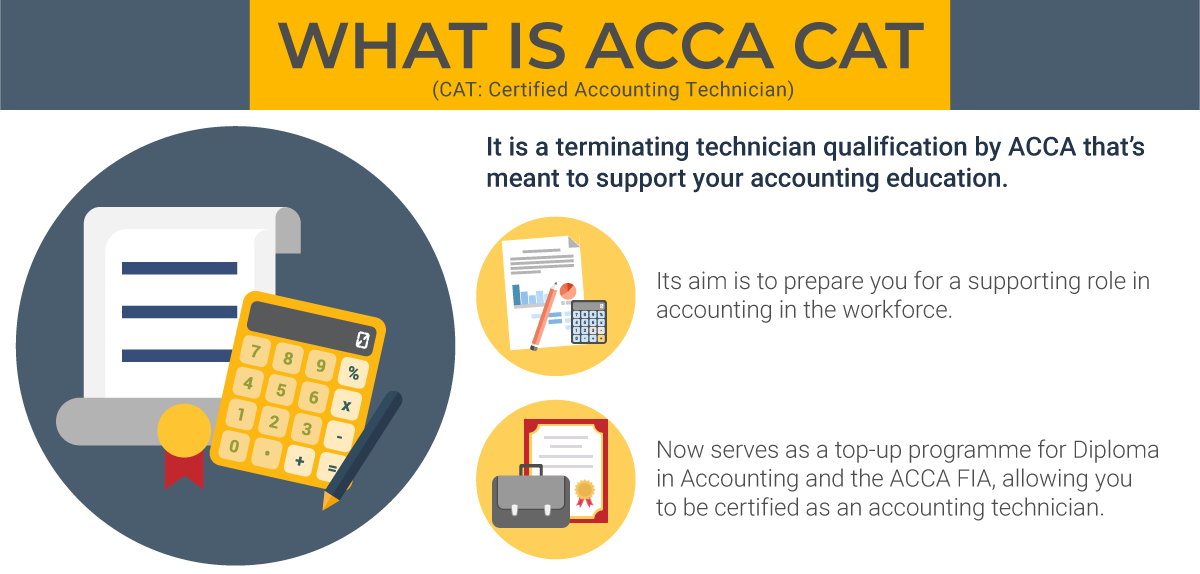

#1. What Is the ACCA CAT Qualification?

CAT stands for Certified Accounting Technician. It is a terminating qualification by ACCA that's meant to support your accounting education. Its aim is to prepare you for a supporting role in accounting in the workforce, equipping you with a strong foundation in financial and management accounting so that you can solve basic accounting problems.

CAT stands for Certified Accounting Technician. It is a terminating qualification by ACCA that's meant to support your accounting education. Its aim is to prepare you for a supporting role in accounting in the workforce, equipping you with a strong foundation in financial and management accounting so that you can solve basic accounting problems.

The CAT programme was formerly a direct pathway into the ACCA qualification from SPM. That role has now been taken over by the ACCA Foundation in Accountancy (FIA). The new CAT qualification now serves as a top-up programme for Diploma in Accounting courses and the ACCA FIA, allowing you to be certified as an accounting technician.

Upon completion of this qualification, you can either proceed to enter the workplace as an accounting technician or continue pursuing ACCA, which is a pretigious professional accounting qualification that's respected by many employers in the accounting world.

#2. CAT Entry Requirements

a) CAT entry requirements

To pursue CAT, you will need to have passed:

- Any accredited Diploma in Accounting programme, or

- ACCA Foundation in Accountancy

#3. Studying CAT in Malaysia

a) What subjects do you study in CAT?

A CAT course has a total of 9 exam papers.

Taking a Diploma in Accounting or ACCA Foundation in Accountancy before pursuing CAT will allow you to apply for up to 7 exemptions, leaving you with only 2 specialist papers. You will need to pick 2 out of the 3 specialist papers below:

- Foundations in Taxation (FTX)

- Foundations in Financial Management (FFM)

- Foundations in Audit (FAU)

In addition to passing the exams, you will also need to:

- Complete a practical experience requirement of 12 months

- Complete an online module on Foundations in Professionalism

Successful completion will grant you CAT holder status.

b) How long is a CAT course?

If you are pursuing all 9 papers under CAT, it will take about 1.5 years to complete.

However, if you are taking the Diploma in Accounting or ACCA FIA route, you only need to take 2 specialist papers, making the duration much shorter.

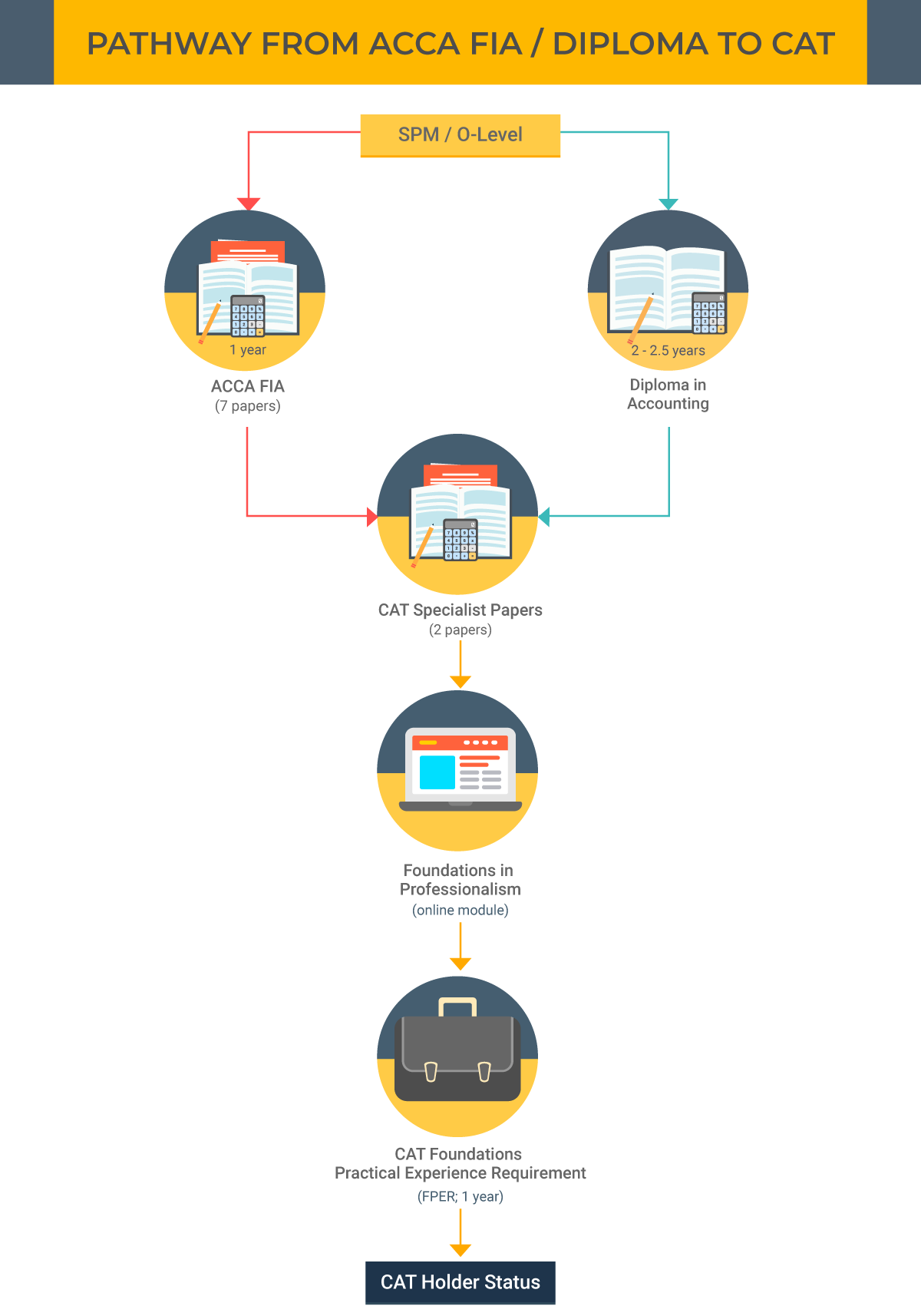

#4. Your Education Pathway for CAT

ACCA Foundation in Accountancy / Diploma in Accounting → CAT

If you plan to take the CAT to be certified as an accounting technician, here's how your education pathway looks like.

If you plan to take the CAT to be certified as an accounting technician, here's how your education pathway looks like.

- Step 1: Complete ACCA FIA or Diploma in Accounting

- Step 2: CAT Specialist Papers (2 papers)

- Step 3: Foundations in Professionalism module (online)

- Step 4: Complete the CAT Foundations Practical Experience Requirement (FPER; 1 year)

- Step 5: Gain the Ceritifed Accounting Technician status

The CAT is a terminating qualification, which means you can use this to find work and apply for jobs.

At the same time, you can still choose to continue with your ACCA:

- Step 6: Take the ACCA Applied Skills level (6 papers)

- Step 7: Take the ACCA Strategic Professional level (4 papers)

- Step 8: Complete the Ethics & Professional Skills module and gain 3 years of practical work experience in a relevant role

- Step 9: ACCA will grant you Chartered Certified Accountant status

#5. Should You Study CAT?

a) Is CAT the right course for you?

A CAT course will grant you the knowledge and skills needed to become a professional accountant.

A CAT course will grant you the knowledge and skills needed to become a professional accountant.

If you’re wondering whether you should study CAT, here are some questions to think about:

- Are you detail-oriented?

- Are you comfortable with numbers and basic mathematics?

- Do you like solving problems and puzzles?

- Do you enjoy rules and structure?

- Do you like to organise and file things properly?

- Are you known for planning things in advance?

- Do you want to enter the workplace immediately after ACCA FIA?

If you’ve answered “yes” to most of these questions, then a CAT qualification may be ideal for you!

b) Skills required to be a Certified Accounting Technician

Here are some of the key skills and qualities you need to develop to be a proficient accountant.

- Good reading comprehension and command of the English language

- Good communication skills

- Competence and confidence in math

- Excellent organisation skills

- Have an eye for detail

- Good IT skills (e.g. proficient in Microsoft Excel)

- The ability to easily adapt to different work environments

#6. What Can You Do With a CAT Qualification in Malaysia?

Under the revamped syllabus, CAT is considered a terminating technical qualification. Here are some of your employment options:

- Junior accounts executive

- Junior auditor

- Junior payroll accounts executive