The Complete Guide to Studying Finance in Malaysia

Explore the finance course in Malaysia including its entry requirements, where to study and career pathways only in this comprehensive guide.

How does a company's stock go up and down in value? What caused the tragic state of our national currency right now? Heck, how do banks even determine how much interest they can charge us?

These are just some of the questions Finance aims to make sense of.

If you’re interested in the study and management of money, find out more about studying Finance and see if this is the right course for you.

Asia Pacific University of Technology & Innovation (APU)

Bachelor in Banking and Finance (Hons)

✓Dual-award degree – one from De Montfort University, UK, and one from APU

#1. The Basics of Finance

a) What Is Finance?

Finance involves the acquisition and management of financial resources (read: money) by institutions, companies and governments.

Since every one of these entities requires money to operate, good financial practices are crucial to ensure that they get the best bang for every single buck.

While finance activities are mostly associated with huge amounts of money (which can easily amount to billions of ringgit), your simple routine of budgeting and distributing your pocket money fairly every month counts as a finance practice too!

Studying a Finance course will allow you to learn how to procure and manage wealth, allocate funds and understand the connection between risk and reward.

Did You Know

Finance is usually a Business degree major, which means that you will be exposed to a wide range of Business fields (e.g. Accounting, Finance, Economics, etc.) before studying Finance in-depth in your final 2 years. However, certain universities may offer a Degree in Finance or even a Degree in Finance & Accounting. Be sure to check the course curriculum to know what you are getting into since they can be fundamentally different.

#2. Studying a Finance Course

a) Entry Requirements & Qualifications

To take up a course in Finance, you’ll need to meet the minimum entry requirements first.

(i) Diploma in Finance

Taking a Diploma in Finance will enable you to join the workforce early. If you’re thinking of taking a Finance Diploma, then the minimum requirement that you’ll need to meet is:

- SPM / O-Level: Minimum 3 credits including Mathematics and a pass in English

Generally, a Diploma in Finance course will take 2 years to complete. You will typically be equipped with sound financial knowledge and skills required to solve finance-related problems.

With a Diploma in Finance qualification, you can choose to join the workforce early to gain practical experience first. Otherwise, you may proceed to a Degree in Finance, directly taking on Year 2 modules for your Degree.

(ii) Degree in Finance

Taking a Degree in Finance will require you to first, complete SPM or an equivalent qualification AND second, obtain a Pre-University or a Foundation programme qualification.

Usually, the minimum entry requirements set for Degree in Finance are:

- A-Level: Minimum 2Ds

- STPM: Minimum 2Cs

- Diploma: Minimum CGPA of 2.50

- Foundation in Arts or Science: Minimum CGPA of 2.50

Generally, you will also need to obtain a credit for Mathematics and a pass for English in SPM in order to pursue a Degree in Finance.

Important Note

Colleges or universities may still set their minimum requirements higher than stated above. Therefore, it's best that you perform the necessary research.

Normally, a Degree in Finance is 3 years long.

By taking a Degree in Finance, you will gain an in-depth understanding of major financial concepts, theories and methodologies. You will also acquire specific financial skill sets that can be applied across a multitude of industries including government bodies and social organisations.

Usually, most Finance Degrees will also require you to carry out a finance-related project or dissertation and go for industrial training during your final year of studies.

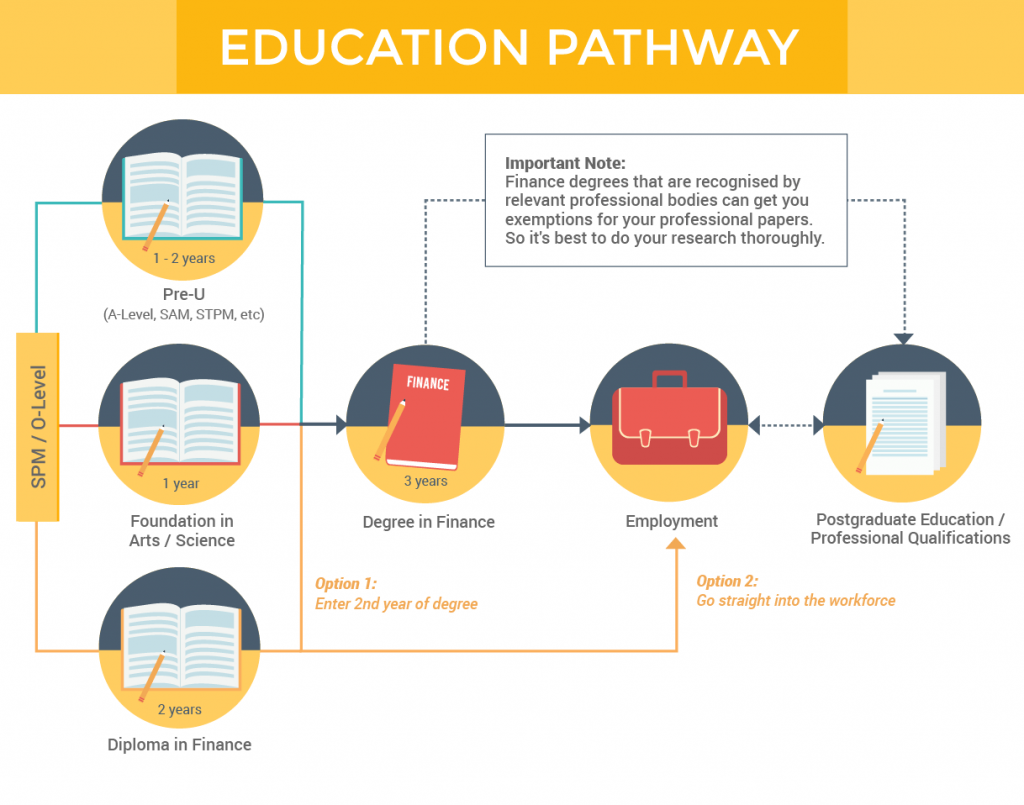

b) How Does Your Education Pathway Look Like?

With the completion of SPM or an equivalent qualification, you can choose to pursue a Pre-University course or a Foundation programme. If not, you can choose to take up a Diploma in Finance too.

Upon completion of any of the courses mentioned above and meeting the minimum requirements, you can then proceed to pursue a Degree in Finance.

But that’s not all!

Aside from progressing to a postgraduate education (read: Masters or PhD), there is also a multitude of professional qualifications that you can pursue after your Finance Degree, depending on which area of Finance (credit, investment, risk, etc.) that you’d like to focus on.

Here are some of the professional qualifications for Finance graduates:

- Chartered Financial Analyst (CFA) from CFA Institute

- Certified Financial Planner (CFP) from Financial Planning Association of Malaysia (FPAM)

- Registered Financial Planner (RFP) from Malaysia Financial Planning Council

In addition, Finance graduates also have the option to pursue professional qualifications in other areas of Business, such as Accounting and Tax. Some examples of such professional qualifications include:

- Association of Chartered Certified Accountants (ACCA)

- Institute of Chartered Accountants in England and Wales (ICAEW)

- Chartered Tax Institute of Malaysia (CTIM)

- Malaysian Institute of Chartered Secretaries and Administrators (MAICSA)

Important Note

c) What Will You Study in Finance?

You will gain extensive and comprehensive knowledge on various finance-related topics ranging from stocks and bonds, domestic and international finance to accounting and economics.

Of course, you will also gain exposure in making sound investment decisions, handling portfolios and assets and managing risk to control losses.

Here are the standard subjects that you’ll take in a Finance course:

- Business Law

- Financial Markets and Institutions

- Investment Analysis

- Financial Risk Management

- Business Communication

- Financial Management

- Principles of Accounting

d) Cost of Studying Finance in Malaysia

The cost to study a Diploma in Finance ranges from RM42,000 to RM 43,000

On the other hand, a finance degree may cost approximately RM92,000 to RM180,000

Asia Pacific University of Technology & Innovation (APU)

APU Foundation Programme (Business & Finance & Psychology)

✓Direct pathway into dual-award degrees at APU

#3. Why Should You Study Finance?

Are you planning to study Finance because Finance-related careers are typically associated with high pay? If you can withstand the intense and stressful environment, why not?

But if you’re looking for stronger reasons to take up Finance, beyond the promise of glamorous job titles and top remuneration packages, then here are a few.

(a) You love tackling and solving complex problems

If you’re one who excels in both your Mathematics and Additional Mathematics subjects, chances are, you’ll probably enjoy the complex hurdles typically found in Finance.

With numerous concepts, theories and principles to grasp and apply, you’ll also need to consider various factors (e.g. money, time, risks, etc.) in your quest to finding the best solution to a finance-related problem.

Simply put, your thirst for challenges can be quenched by studying Finance.

(b) You are meticulous and have a keen eye for detail

Do you have a habit of proofreading your essays at least 2 – 3 times in school? Or have you ever been asked by your friends to check their homework for them?

Having such a strong attention to detail will be a vital quality in Finance as you’ll be poring over endless pages of reports and data. It could potentially spell disaster if you mistake 100,000 for 1,000,000.

(c) You enjoy reading business news

To excel in Finance, not only will you need to be proficient with various finance methodologies, concepts and theories, you are also expected to keep yourself abreast of the latest business trends and major economic activities.

If you already enjoy examining the business sections of your daily newspaper, you can easily make sense of what you’ve learned in the news with what you’ll be learning in Finance.

#4. What Skills Do You Need for a Finance Course?

To thrive in a Finance course, you’ll need to possess qualities that can help you perform well in a dynamic course like Finance.

Here are some of the major skills that you’ll need in order to succeed in a Finance course.

(a) Stellar communication and articulation skills

The field of Finance is one filled with countless jargon and fancy words that an average person would find complicated and hard to understand.

And that’s exactly where the challenge lies for you.

The ability to convey your message in layman terms will be extremely crucial in your Finance projects and presentations. This is certainly even more critical in your work later on when you need to maintain constant communication with various stakeholders.

(b) Strong analytical and critical thinking skills

A lot of answers that you seek in Finance may fall in the grey zone so you’ll need to rely on plenty of strong critical analysis and logical thinking to find the best solutions.

You’ll need to be able to justify your answers with critical interpretations, backing them with facts and numerical and statistical data.

And of course, you will be expected to do the same when it comes to your work in the Finance field later on.

Asia Pacific University of Technology & Innovation (APU)

Bachelor in Banking and Finance (Hons)

✓Dual-award degree – one from De Montfort University, UK, and one from APU

(c) Ability to work under immense pressure and stress

Finance, like any other field in Business, is stressful and constantly changing.

So expect to be presented with a seemingly endless flurry of assignments, projects and case studies on different finance-related scenarios that you need to complete within a short time frame.

This will definitely be good preparation for you because once you set foot in the working world of Finance, all your struggles in university will probably seem like child’s play.

#5. What Career Options Do You Have with a Finance Degree?

Generally, Finance graduates can seek employment opportunities from a wide range of industries from banks and securities trading companies to government and consultancy institutions.

Here are some Finance-related careers that you can seek upon graduating:

- Accounts Executive

- Costing Officer

- Credit Analyst

- Financial Analyst

- Income Auditor

- Investment Banker

- Tax Analyst

- Treasury Executive

With that being said, you can also pursue the relevant professional qualifications to seek more advanced career options or start your own financial advisory or consulting business.

#6. Where Can You Study Finance in Malaysia?

Does a Finance course tickle your fancy? Then check out some of the best universities to study Finance in Malaysia.

Asia Pacific University of Technology & Innovation (APU)

Bukit Jalil, Kuala Lumpur

Bachelor in Banking and Finance (Hons)

Intake

Mar, Jul, Sep, Nov

Tuition Fees

RM92,000

Malaysia's award-winning Premier Digital Tech University